Credit karma revenue 2019

February 24,is a day Ken Lin will never forget. Meanwhile, the stock market was in free fall. We had a lot of decisions to make.

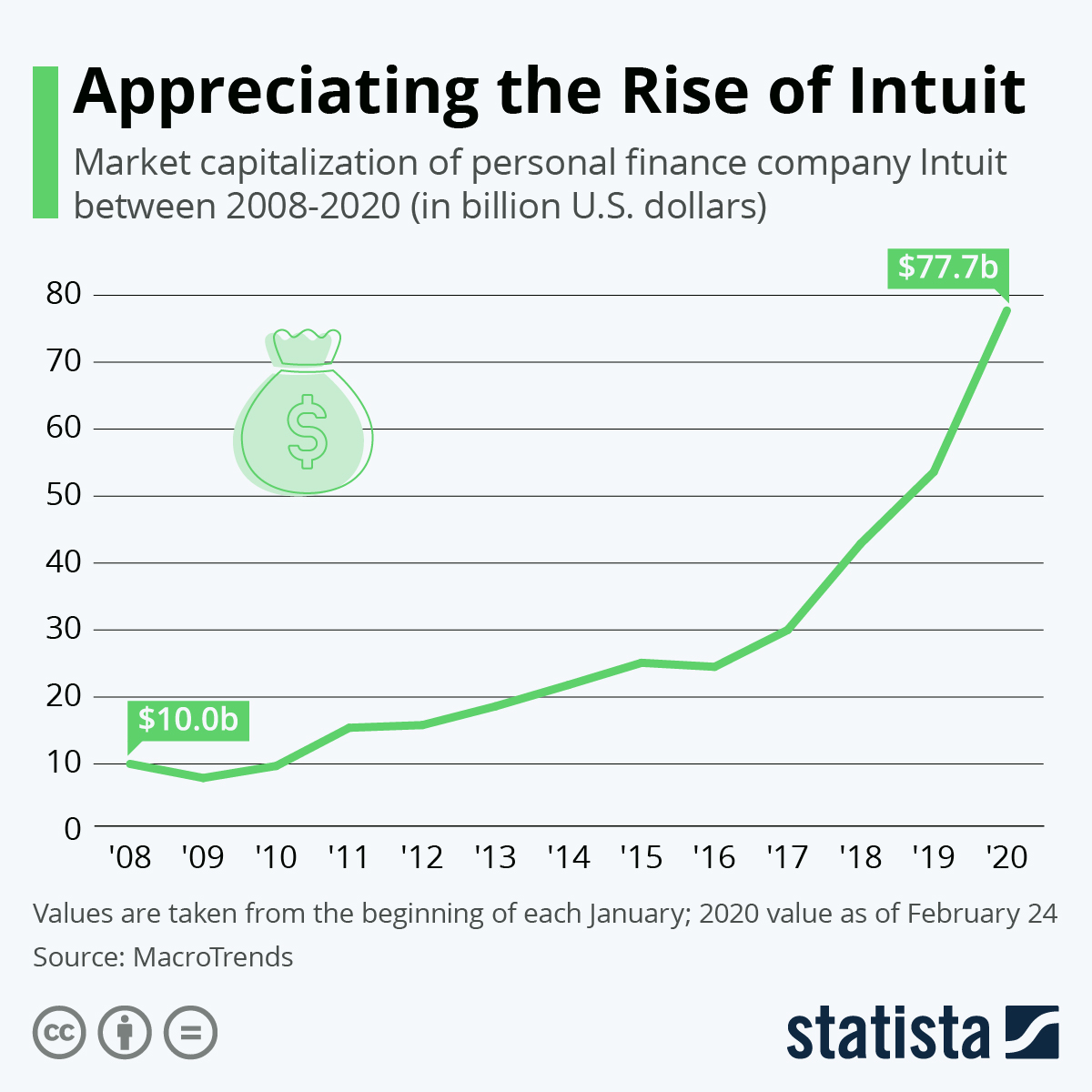

Note: This headline and article was updated post-publication with confirmation of the news. Rumors swirled over the weekend that Intuit Inc. The Wall Street Journal broke the news. Subscribe to the Crunchbase Daily. As the WSJ reported, such an acquisition would help propel Intuit further into the consumer finance space.

Credit karma revenue 2019

Do you know your credit score? Credit Karma will show it to you for free. How does a company offering free services make money? This article reviews Credit Karmas' revenue model. Credit Karma makes money by charging referral fees, interest on cash, and interchange fees. Founded in , this fintech firm helps Americans manage their finances and investments, allowing them to control their spending, saving, and investing. So, what does Credit Karma do, and how does it earn money? The founder started Credit Karma after frustration around retrieving his credit score. Private firms offered to retrieve users' credit scores, but many of them had shady reputations. With the launch of Credit Karma, Americans now had a third-party provider they could trust with personal and financial information. Credit Karma launched in March , offering users the chance to find out their credit score without going through credit bureaus like TransUnion or Equifax. Credit Karma is a leading fintech company specializing in the financial well-being of its users.

Coming up next.

Credit Karma is an American multinational personal finance company founded in It has been a brand of Intuit since December All of Credit Karma's services are free to consumers. Credit Karma earns revenue from lenders, who pay the company when Credit Karma successfully recommends customers to the lenders. In December , Credit Karma acquired mobile notifications app developer Snowball for an undisclosed amount.

From the consumer perspective, Credit Karma is a place to monitor credit, do taxes and get budget and financial product advice. And it works famously. Credit Karma has grown to million consumer members since launching in March This many people have their credit report data connected, and increasingly are doing their taxes there. Of the million consumer members, 37 million use Credit Karma more than four times per month.

Credit karma revenue 2019

February 24, , is a day Ken Lin will never forget. Meanwhile, the stock market was in free fall. We had a lot of decisions to make.

Solve hogwarts secrets challenge

As required by the Tunney Act, the proposed consent decree, along with a competitive impact statement, will be published in the Federal Register. May 7, This article reviews Credit Karmas' revenue model. The New York Times. October 8, The department said that without this divestiture, the proposed transaction would substantially lessen competition for digital do-it-yourself DDIY tax preparation products, which are software programs used by American taxpayers to prepare and file their federal and state returns. Of course, there are some areas where the companies must integrate as part of a publicly traded company — like anything that includes financial controls or compliance — but for most people at Credit Karma, little has changed over the past year. In , Credit Karma acquired money reclamation service Claimdog. Show More Fintech Companies. Archived from the original on January 15, Some of the products and services listed on our website are from partners who compensate us. Retrieved March 2,

The combination brings together two technology leaders focused on personal and small business owner financial challenges that include paying taxes, managing debt, maximizing savings, business accounting, accessing better credit cards and loans — and even recommending car and home insurance, a market Credit Karma entered in Credit Karma serves consumers by matching them with financial services providers.

Retrieved December 23, The Mercury News. Competitors Credit Karma is a leading fintech providing a range of financial services designed to improve consumer financial health. The combination of Intuit and Credit Karma would eliminate this competition, likely resulting in higher prices, lower quality, and less choice for consumers of DDIY tax preparation products. Retrieved January 2, Credit Karma makes money from interchange and referral fees, and interest charged on cash loans which is a common practice at larger financial institutions. The Wall Street Journal broke the news. Toggle limited content width. Follow us on LinkedIn 4. Retrieved July 27, For Credit Karma, was a challenging year.

0 thoughts on “Credit karma revenue 2019”