Commbank goal saver account review

This product is not currently available via Finder. Visit the provider's website directly, or compare other options.

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access.

Commbank goal saver account review

Open in NetBank. Open now. Earn bonus interest when you grow your savings balance each calendar month excluding interest and bank-initiated transactions. See how much you can save with our savings calculator , set up regular automatic transfers to keep you on-track, and set a savings goal in the CommBank app with Goal Tracker. One bonus interest rate applies to your entire balance. The interest rate depends on your account balance. You can open online now or visit your nearest branch. Then supercharge your savings with recurring payments from the CommBank app or NetBank. See all bank account FAQs. You may be eligible for 2 fee-free assisted withdrawals if you have an Australian Age, Service or Disability pension credited directly into the account.

Disclaimer and important things you should know. View more A-Z. For joint accounts: To open a joint account, please visit your nearest branch together.

Help us improve our website by completing a quick survey. Start survey now. Update now. Personal Bank Accounts. Save time by using NetBank. Register now.

CommBank's Goalsaver strikes a balance between a competitive interest rate, and few conditions. When you're looking for a saver account, you pay attention to the interest rate first of all, as this determines how much of a return you'll get on the money you deposit. Secondly, you look at the features and perks that the account offers, as well as any rules that might apply to your handling of the account. Ideally, you want a good rate of interest that's fairly fuss-free. If you're wondering what the conditions might be, examples include having to deposit a minimum amount each month in order to earn a bonus interest rate.

Commbank goal saver account review

With the Commonwealth Bank GoalSaver, disciplined savers will be rewarded with a maximum interest rate of up to 4. Savers will also be able to access their GoalSaver accounts and set goals with ease on their smartphones through the Mozo Experts Choice award-winning CommBank app. For all balances, the Commonwealth GoalSaver offers a 4. The GoalSaver is available to both new and existing customers, so Commonwealth Bank loyalists can simply switch and sign up. Interest is calculated daily and paid every month. Transactions can be made using the app, over the phone or via internet banking, but old-school customers will be pleased to know that the Commonwealth GoalSaver also offers branch and ATM access.

Standard of comparison crossword clue 9 letters

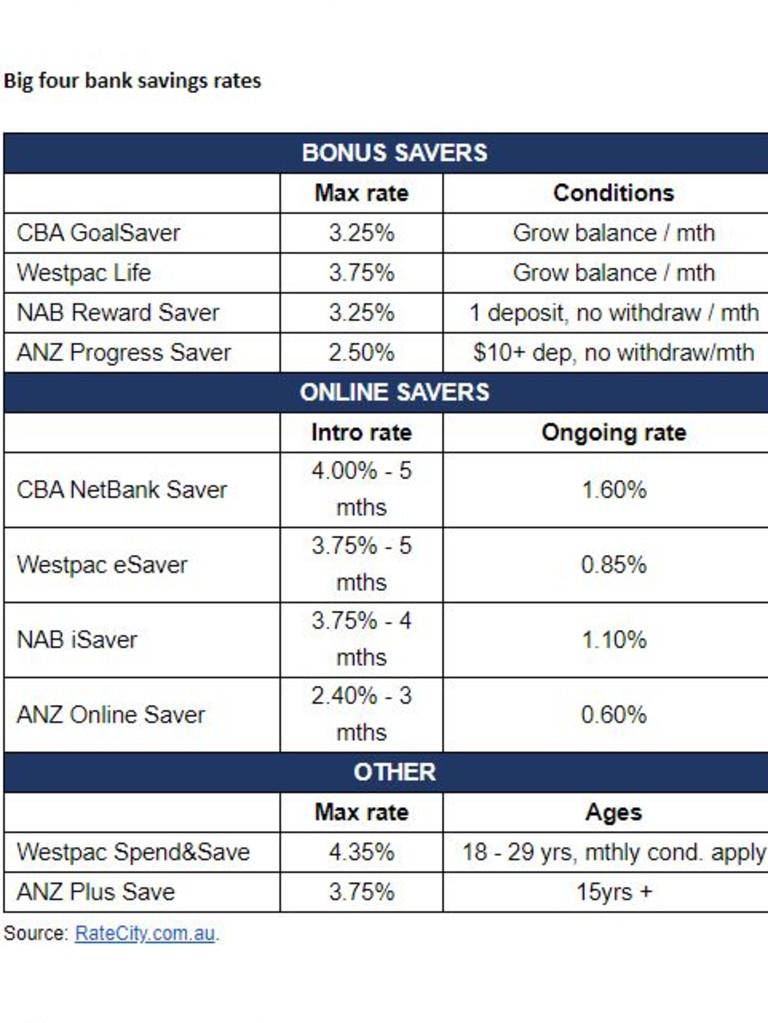

They can also provide you with enquiry-only NetBank access to check your savings online. Hazel December 03, Ongoing fees CBA may not charge monthly account fees, but they still charge fees for over-the-counter withdrawals and receiving a printed statement in the mail. Great Southern Bank. See how much you can save with our savings calculator , set up regular automatic transfers to keep you on-track, and set a savings goal in the CommBank app with Goal Tracker. New and existing customers welcome New and existing customers to Commonwealth Bank are welcome to apply for this product. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. Download the CommBank app:. Michael January 22, An account that gives you a competitive interest rate when you lock away your funds for a term of your choice - from 1 month up to 5 years. There are a few eligibility requirements for this account that you should ensure you can meet before going forward to the application page, and some documentation that you should have handy. At the end of the introductory rate period, the NetBank Saver standard variable rate applicable at that time will apply. Big 4 Banks. This account gives you instant access to your money while also allowing you to earn modest daily interest. Standard Variable Rate 2.

Open in NetBank.

Share Trading. This account can also be opened as a joint account. Everyday Account Smart Access. See all fees which may apply to this account. Youthsaver As is the case with many youth savings accounts , this is designed as a tool for parents to teach youngsters how to save. Maximum interest rate of 4. Richard Whitten Finder January 22, Unlike some competitors who offer very high bonus interest rates, CBA offers less competitive rates for meeting the required criteria up to a maximum of 0. If they do your banking, they can link your Youthsaver to their CommBank accounts and their NetBank, making it easy to access. Be rewarded for saving regularly Simply grow your balance by the end of every calendar month excluding interest and bank initiated transactions to earn bonus interest. Angus Kidman Finder. Access your money online, in branch or over the phone. To ask a question simply log in via your email or create an account.

Completely I share your opinion. In it something is also idea good, I support.