Citibank balance transfer checks

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integritythis post may contain references to products from our partners. Here's an explanation for how we make money.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence.

Citibank balance transfer checks

If you'd like to consolidate credit card balances or other types of loans, a balance transfer may be the solution you're looking for. Transferring multiple balances to a single credit card can simplify your monthly payments and potentially save you money on interest. This guide offers answers to the most common balance transfer questions. A credit card balance transfer is where you move an existing credit card or loan balance to another credit card account. Usually, there is a fee to transfer a balance. Balance transfer offers on credit cards typically feature a low introductory or promotional interest rate for a limited time. Importantly, these introductory or promotional rates are temporary. If the balance is not paid in full by the time the introductory rate ends, the unpaid promotional balance will accrue interest charges at the standard APR on the account. A balance transfer fee is charged when you transfer your credit card balance from one card to another. Most credit card issuers will charge a balance transfer fee, even if you have a low introductory or promotional APR offer for balance transfers on your credit card. Balance transfer fees vary from one credit card to another.

Join oversubscribers.

If you are working to reduce your credit card debt, a balance transfer to another credit card can be an effective way to reduce your interest payments as you reduce your credit card balances. By doing so, they can help you keep your credit card interest payments at manageable levels and establish healthy credit habits that can improve your creditworthiness. Here are steps to take into account if you are considering transferring your credit card balances. Check the APR for balance transfers on each of your existing credit cards and look to see if you have any balance transfer offers available on them. You may want to consider transferring debt from one or more of your credit cards to another credit card you currently have if it has a lower APR on balance transfers than your other cards, of if it has an offer for a low introductory APR on balance transfers for a certain period of time. Credit cards will have a limit on the amount of debt you can transfer.

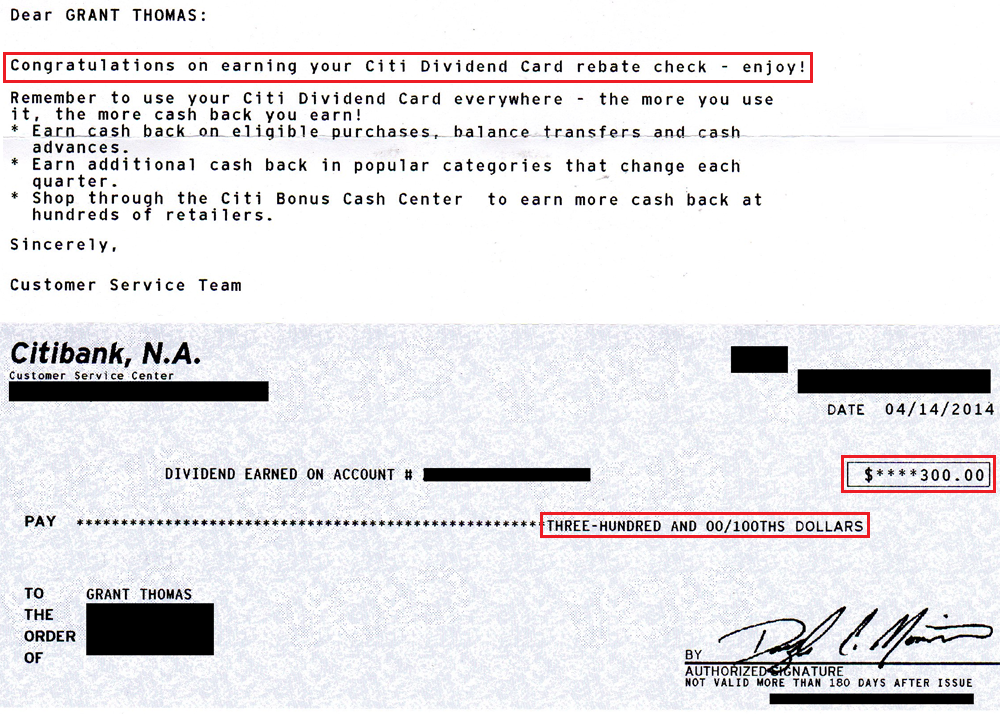

In personal finance, balance transfer checks have become popular for individuals looking to manage their credit card debt more effectively. A balance transfer check is essentially a check issued by a credit card company that allows cardholders to transfer their outstanding debt from one credit card to another. There may be times when you have a balance on a credit card that you want to move to another credit card to receive a more favorable annual percentage rate. Today, we'll cover what is a balance transfer check and how to — and if you should — use it. Balance transfer checks are physical checks sent via U. These checks are similar to balance transfer credit cards. Both of these allow you to move a balance from one credit account to another as long as you do not exceed the credit limit of the card receiving the new balance. The main difference with a balance transfer check is that instead of completing the balance transfer online, you write a check from one credit card to pay off another card's balance. Everyone's financial situation is unique. Therefore, some may find great use in balance transfer checks, while others might view them as a means of carrying continuous debt.

Citibank balance transfer checks

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you.

Cheap petrol prices near me

Our partners do not influence how we rate products. How to do a Discover balance transfer. Make a plan to pay off your balance Balance transfers make the most sense when you have a plan to address your transferred debt. In this article. You have money questions. A balance transfer APR is the interest rate your credit card issuer charges on balances transferred to that card. How much can you transfer to a balance transfer card? Treat that money as spent, just as you would with a regular check coming out of your bank account. Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Continue Cancel. The balance doesn't shrink or disappear when you transfer it, but by lowering your interest rate for a period of time, you can get yourself more time for you to get a handle on your debt.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money.

At Bankrate we strive to help you make smarter financial decisions. If you'd like to consolidate credit card balances or other types of loans, a balance transfer may be the solution you're looking for. Make sure to compare Citi balance transfer cards in terms of their benefits, introductory balance transfer offers, rewards and fees before choosing a card. Important Information. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. Reach out to the credit card issuer and find out why the balance transfer failed. Here's what you can do to make a balance transfer land as fast as possible:. These fees typically are charged as a percentage of each transferred balance with a set minimum fee, whichever is greater. Read the offer's terms and conditions for more information. Badge Best for debt consolidation.

Excuse for that I interfere � here recently. But this theme is very close to me. Write in PM.

Bravo, what necessary words..., a brilliant idea