Cibc heloc

Opens in a new window. Learn more about the mortgage offer.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free.

Cibc heloc

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free. Learn more about tax-free savings accounts. Meet with us Opens in a new window. Life Moments. How To. Tools and Calculators. Learn more. Find out how much you may qualify to borrow through a mortgage or line of credit.

Travel Insurance. Opens in a new window.

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Start saving today, tax-free.

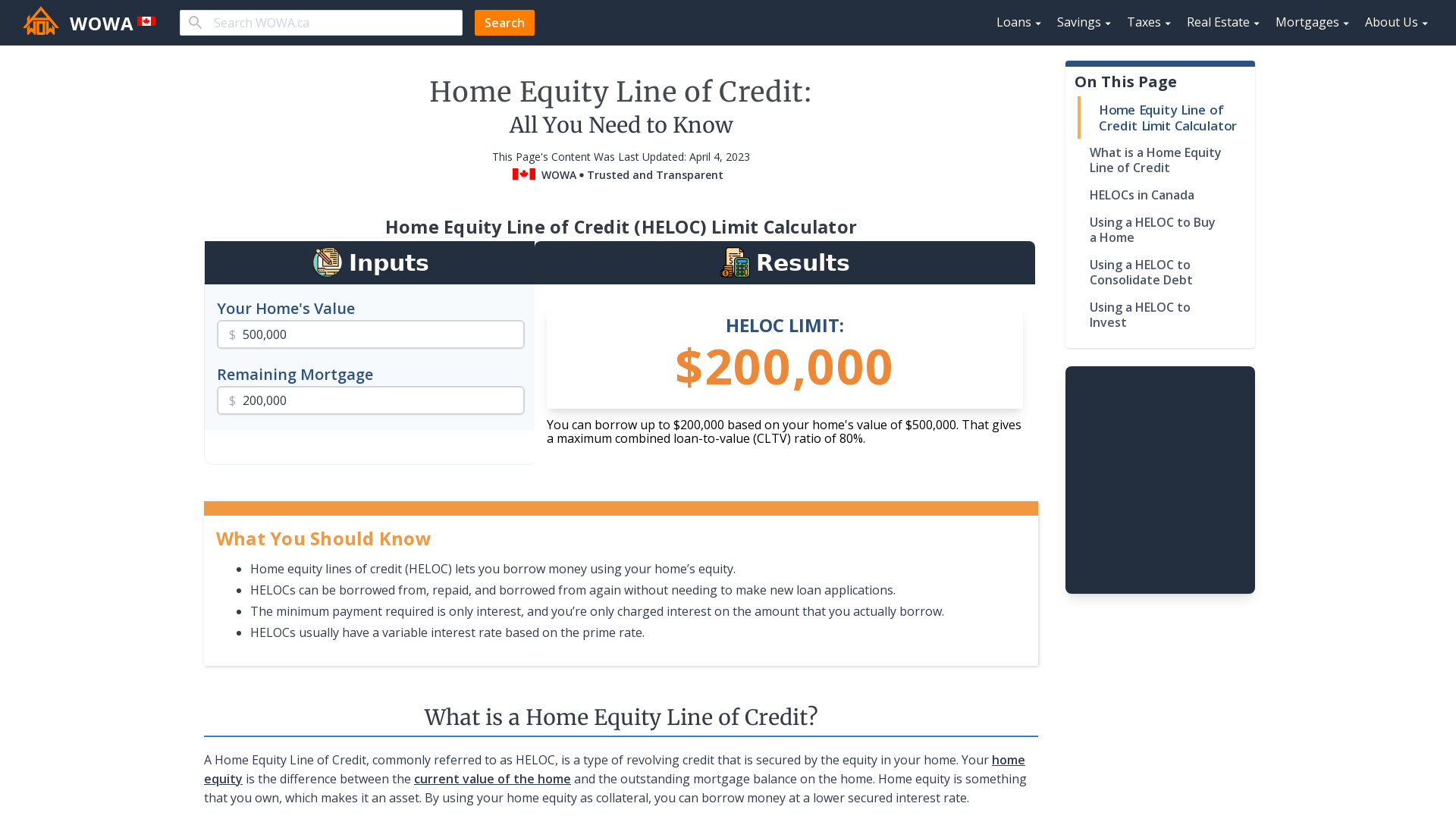

Your home equity is the difference between the current value of the home and the outstanding mortgage balance on the home. Home equity is something that you own, which makes it an asset. By using your home equity as collateral, you can borrow money at a lower secured interest rate. HELOCs are revolving accounts, which means that you can borrow, repay, and borrow money again. HELOCs usually only have a minimum monthly payment that is just the interest. Since your home equity increases as you make mortgage payments, where your principal gets paid down, some HELOCs may even have a credit limit that automatically increases as your equity increases. This is known as a readvanceable mortgage and could be offered by some lenders when you have both a mortgage and a HELOC together. HELOCs are flexible because they allow you to borrow money whenever you want, and you're only charged interest on the amount that you actually borrow. They also usually only have minimum monthly payments of interest and fees, making HELOC payments lower than mortgage payments. You can also repay some or all of a HELOC at any time, and should you wish, you can reborrow these amounts again as well.

Cibc heloc

Opens in a new window. Learn more about the mortgage offer. A line of credit to help conquer your goals.

Ritzy wine tapas bar

Credit Cards. Tools and Calculators. Reusable credit : As you pay down your line of credit, you'll still have access to the full limit. A line of credit to help conquer your goals. Ways to Bank. Travel Insurance. Get expert help with accounts, loans, investments and more. Learn more about tax-free savings accounts. Find a banking centre Opens a new window in your browser. Travel Insurance. Shop stress-free with our tools and advice. Learn more. Bank Accounts Bank Accounts.

Opens in a new window. Learn more about the mortgage offer.

ESC to close a sub-menu and return to top level menu items. Refinance your mortgage or use your home equity. Tools and Calculators. How much do you owe on your home, including your mortgage balance and any other secured debt? Meet with us Opens in a new window. Tools and Calculators. Offers and Bundles. As a homeowner, it allows you to borrow against the equity of your home. That value can then be used as security for a loan or line of credit. United States. Food costs were also a key factor, as they were down markedly to 3. The number of new listings rose slightly in January by 1.

0 thoughts on “Cibc heloc”