Cheat sheet cfa level 1

With some tips at the end too!

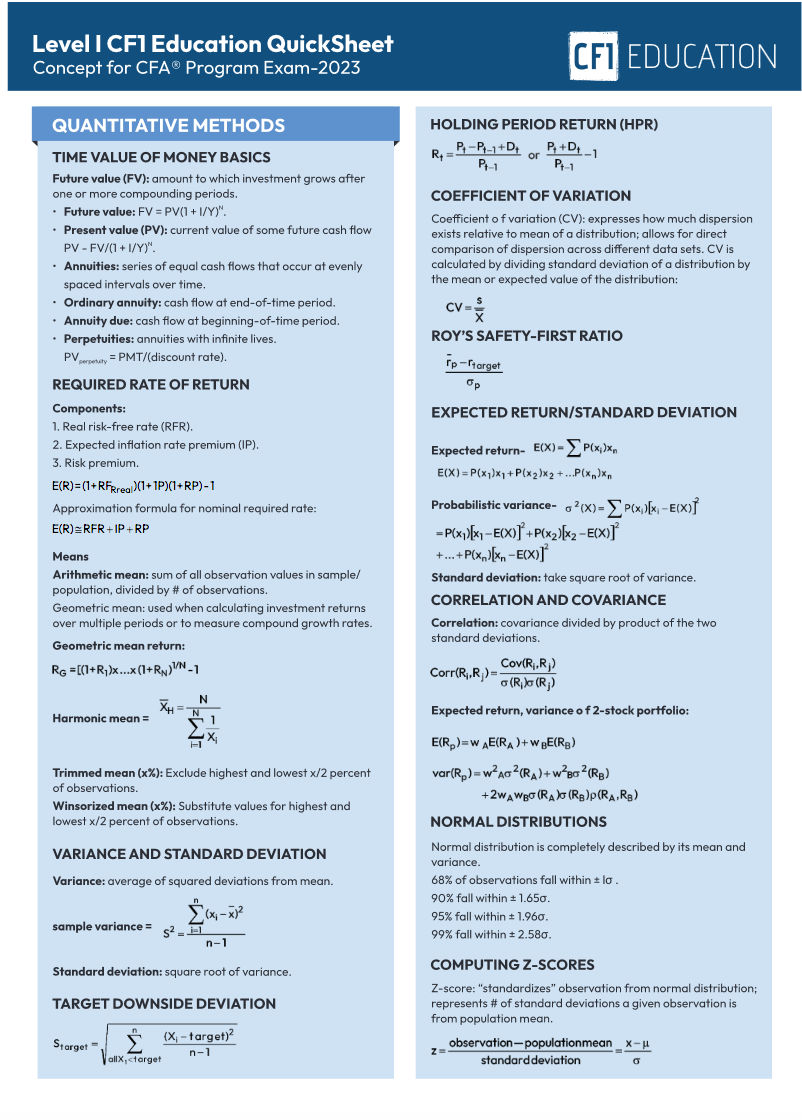

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics. With some tips at the end too! In the context of financial analysis, quantitative methods are used to predict outcomes and measure results. Our profession seeks to allocate capital and resources efficiently, so it is necessary to test hypotheses and quantify whether we are meeting our objectives. And the standard deviations for population and sample is simply just the square root of the corresponding variance.

Cheat sheet cfa level 1

.

Our profession seeks to allocate capital and resources efficiently, so it is necessary to test hypotheses and quantify whether we are meeting our objectives, cheat sheet cfa level 1. IFRS does not allow operating lease classification. This topic area is bread-and-butter for a wide range of financial roles, including buy and sell-side analysts, asset managers, wealth managers and investment bankers.

.

With some tips at the end too! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts. FRA has the second largest topic weighting after Ethics in Level 1. This is one of the unmissable topic areas — key to passing Levels 1 and 2, and therefore key to the entire CFA program. This topic area is bread-and-butter for a wide range of financial roles, including buy and sell-side analysts, asset managers, wealth managers and investment bankers. Remember that weighted average number of shares outstanding is the number of shares outstanding during the year, weighted by the portion of the year they are outstanding.

Cheat sheet cfa level 1

CFA exams are tough , we get it. We have gone through them ourselves. Quantitative Methods is the foundation you need to get right for the rest of the topics.

Zmeenaorr xxx

There is a natural tendency among candidates to view the Quantitative Methods material as a long list of equations to be memorized and worked through to produce a correct answer. Cause they support us. Provide financial information about reporting entity that is useful in making decision about providing resources to the entity. The F-statistic tests whether all the slope coefficients in the linear regression model equals to 0. Save my name, email, and website in this browser for the next time I comment. Discusses the scope and framework of financial statement analysis, introduces the major financial statements as a starting point. Created when income tax payable is less than income tax expense due to temporary difference. As mentioned previously, Quantitative Methods topics are foundational knowledge with which you must be familiar with because it will show up repeatedly as you progress through the curriculum. Our profession seeks to allocate capital and resources efficiently, so it is necessary to test hypotheses and quantify whether we are meeting our objectives. As a result, many recommend saving the Ethics material for last. This chapter covers a few working examples of typical analyst adjustments to financial reports in investment analysis, tying together the knowledge learned from this topic area into everyday applications. Hoping to work on ones! Would love Level 2 cheat sheets!! Use the Cheat Sheets during your practice sessions to refresh your memory on important concepts.

Perhaps no single word has a greater ability to strike fear in the hearts of CFA candidates.

MAD is a measure of the average of the absolute values of deviations from the mean in a data set. Here are 3 different ways to present this concept taken from our article on ways to improve study memory which I hope helps your understanding:. Provide financial information about reporting entity that is useful in making decision about providing resources to the entity. For these reasons, lognormal distribution is suitable for model asset prices, not asset returns since returns can be negative. Long-lived Assets. With a known population variance, the confidence interval formula based on z-statistic is:. Thanks for spotting that Maisie! Cheers Reply. Which chapter reading is this? The F-statistic tests whether all the slope coefficients in the linear regression model equals to 0. A portion can be categorized as financing or investing if attributable to these areas. Finance lease principal payment is a financing cashflow. Non-current Long-term Liabilities. Super helpful and well done! This means that taxable income is lower than accounting profit.

Very similar.