Cheapest renters insurance

Many or cheapest renters insurance of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

A landlord's homeowners insurance policy doesn't cover a renter's personal possessions, so if you're a renter, you'll need renters insurance to protect your belongings. Renters insurance generally covers three areas: personal property, personal liability and additional living expenses incurred if your rented home is uninhabitable. Personal property includes electronics, clothing, furniture and even kitchen and bath supplies. Liability coverage protects you financially from damages you cause to others, generally for bodily injury or property damage. Additional living expenses coverage also called ALE can help pay for a short-term rental and additional expenses like restaurant meals, for example. If you're looking for cheap renters insurance coverage, CNBC Select narrowed down the top four renters insurance providers based on price and coverage quality.

Cheapest renters insurance

We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and prepare them for the future. The place you rent is your home, and like a home, you want it protected. Allstate renters insurance is not only reliable, but is also affordable and can cost less than you think. Gain peace of mind knowing you have quality coverage from a brand you can trust. Similar to home insurance, renters insurance is a policy that protects you, your belongings and your living arrangements. It also typically includes other coverages like family liability coverage, additional living expenses and guest medical protection. Request a renters insurance quote from Allstate today. There are typically four different types of renters insurance coverages included in an Allstate policy: personal property, liability, guest medical and additional living expenses. Coverage Example Personal property protection covers the loss of your belongings if they're stolen or damaged both inside and outside of your home. Family liability protection can help protect you from financial loss if you're legally obligated to pay for another person's injuries or damage to another person's property. What if you are over at a friend's house and accidentally sit on their brand-new drone, breaking the camera lens? This coverage could help you pay for the repair. Guest medical protection can help pay medical expenses for someone injured in an accident at your house. Let's say a guest in your residence trips over the rug in your living room and it causes him to fall. You may be found negligent and, therefore, be legally responsible to pay for the injured person's medical bill and lost wages.

Power, Nationwide is the highest-ranking company for customer satisfaction in renters insurance. Get started.

Content on Quartz Advisor is commercial in nature and independent of Quartz Editorial and Advertising. Quartz Advisor content is free to consumers and always will be, however we and our partners may be compensated if you purchase a product or service through the links on this website. Get a quote using the form below. Amanda Lutz is a content marketing manager and writer with nearly a decade of experience contributing to prominent home services and wellness publications like AD, This Old House, and MarketWatch. She has written extensively on topics spanning insurance products, lawn care, pest control, and other home services. Finding an affordable renters insurance policy is easier than you think. To help you find the most affordable renters insurance options that meet your needs and budget, Quartz Advisor Reviews Team compared renters insurance providers and looked at pricing, coverage, and available discounts to help determine which one is the best renters insurance company for you.

With just a few clicks you can access the GEICO Insurance Agency partner your boat insurance policy is with to find your policy service options and contact information. Read more. Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away. Simply, login to your auto policy to manage your umbrella policy. Our experienced agents can help you with any paperwork and to manage your policy. Call us if you have any questions about this valuable coverage. Need to make changes to your travel policy?

Cheapest renters insurance

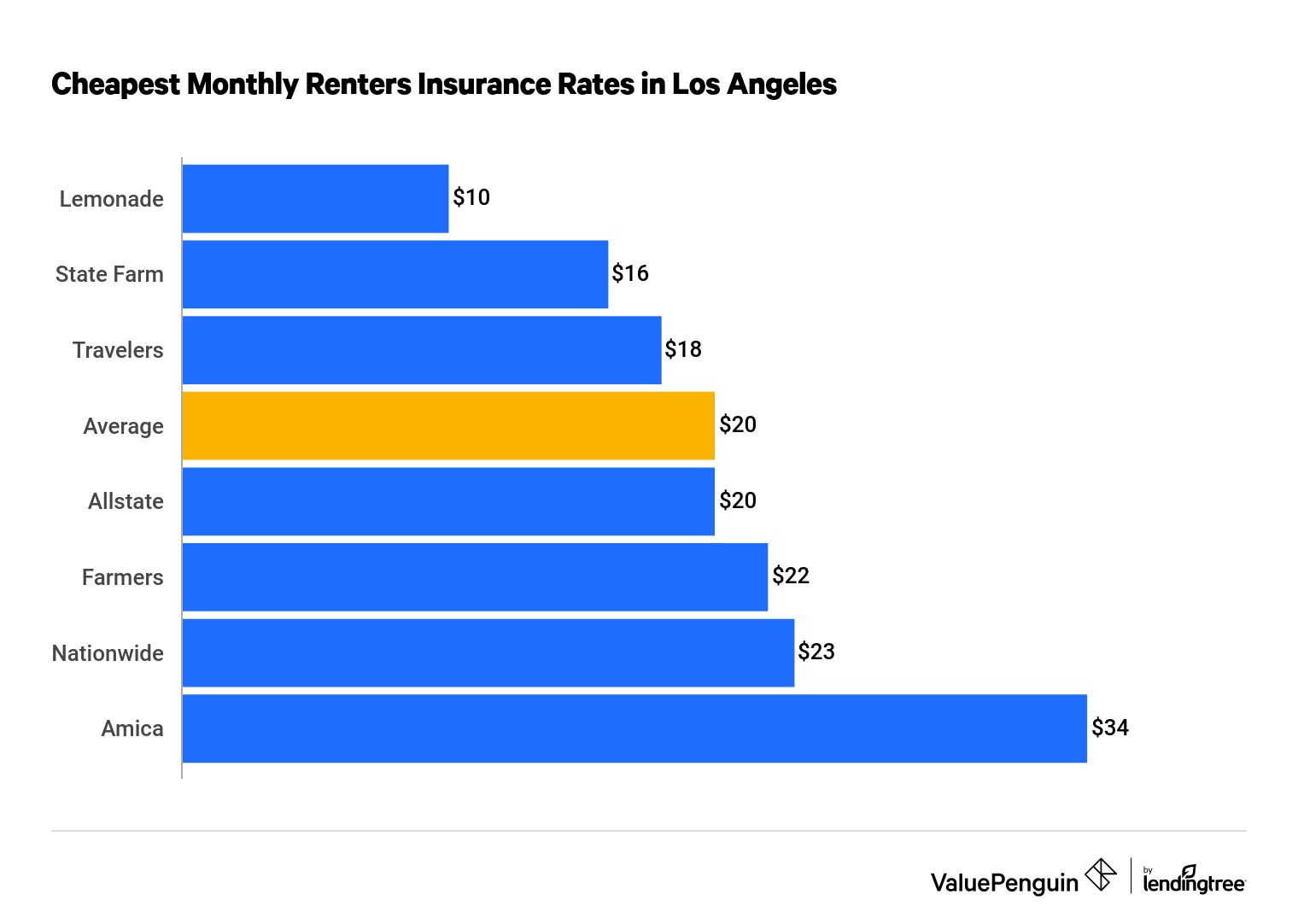

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. The best cheap renters insurance companies offer both. NerdWallet analyzed rates across the country to find the cheapest renters insurance companies in each state and in 25 major cities, plus average nationwide rates for several highly rated companies. Your own rates will vary based on where you live, how much coverage you choose and other factors.

Censured crossword clue

State Farm. Mark Friedlander Advisor. High-value items, water backup, earthquakes, theft of items stored in motor vehicle, trailer, or watercraft; additional coverage can be purchased for these instances. Car insurance rates are expected to rise 8. Renters insurance covers your belongings, any expenses you could incur if your rented home becomes uninhabitable and your liability for bodily injury or property damage to others. A cheap policy should still provide enough coverage for your belongings and liability protection in case of an accident or other incident. Doing this can help you find a policy that fits your budget while still providing adequate coverage for your personal belongings. Windstorm mitigation discounts Available for Florida homes that have documented wind-damage mitigation features, which protect against wind and rain damage present in hurricanes and other severe windstorms. Preferred payment discount: This discount is available when you enroll in an automatic payment plan. Nationwide Our Pick for Valuable Endorsements. What information do I need to get a renters insurance quote?

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More.

If you are looking for a more customizable option for your renters insurance, Toggle may be worth considering. The Guides Home Team also consulted industry experts on shopping for cheap renters insurance. However, this does not influence our evaluations. SUPER: liability — VO: Now, let's go over liability protection which helps if you are responsible for injury or property damage. Be sure to select the same deductible on each coverage for each renters insurance quote you get. South Dakota. Latest When to expect your tax refund in Dan Avery TaxSlayer review: An affordable way to file that works for almost any situation. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Below, see which widely available insurance companies offer the most affordable renters insurance for people with poor credit, on average. We compared rates for 10 large renters insurance companies across various U.

0 thoughts on “Cheapest renters insurance”