Chase international fees

It chase international fees your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. Traveling abroad can be both exciting and stressful.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. You've returned from vacation abroad, only to discover that your credit card statement includes charges you've never seen before: foreign transaction fees. Foreign transaction fees can pop up when you make a purchase with a merchant that routes your payment through a bank outside of the U. Foreign transaction fees aka international transaction fees can vary depending on your credit issuer or bank and the total purchase amount. Check out your cardmember agreement for details on fees for international purchases.

Chase international fees

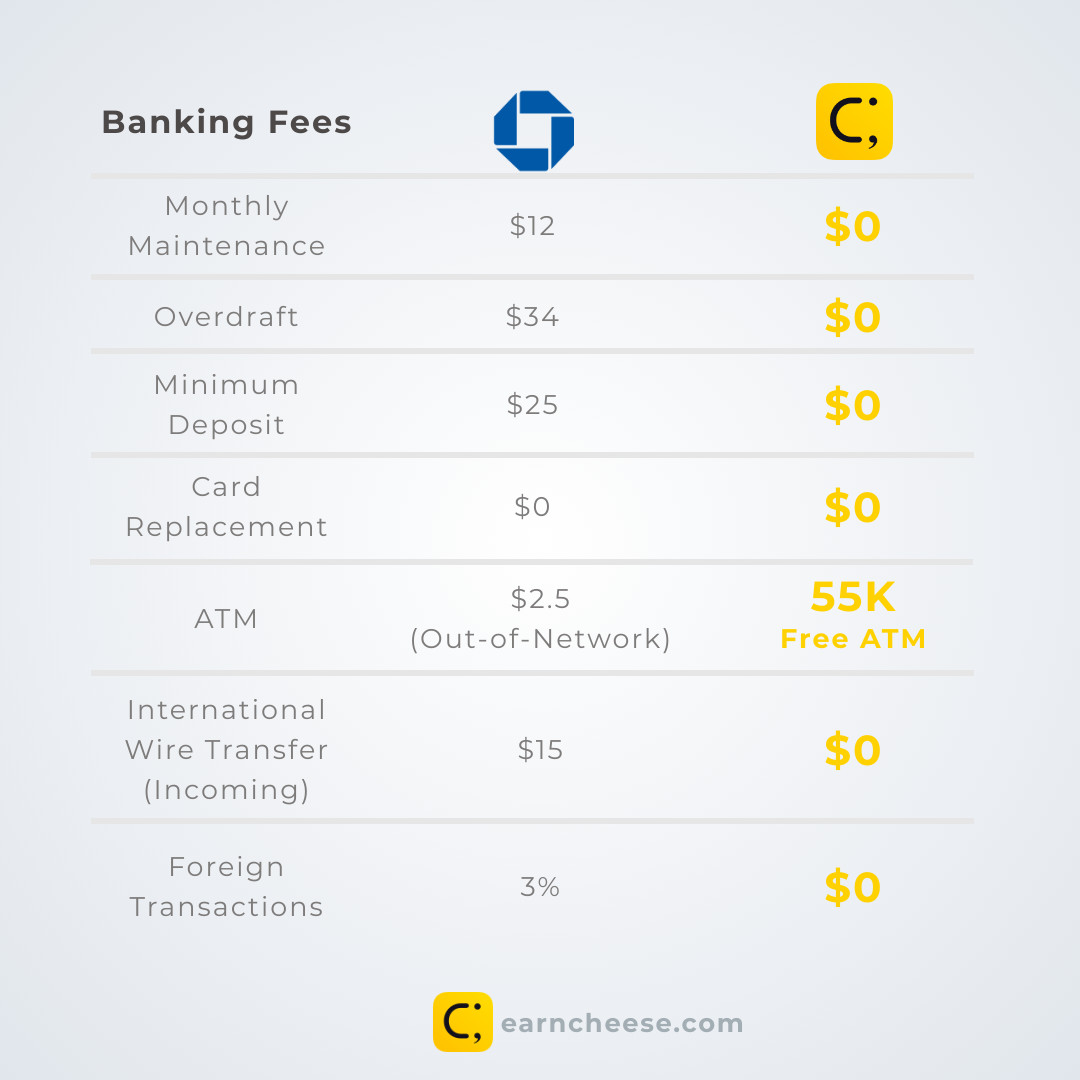

Chase offers both credit and debit cards which can be broadly used for international spending. In fact, there are specific travel credit cards like the Chase Sapphire Preferred and the Chase Sapphire Reserve credit cards which offer travel based rewards alongside no foreign transaction fees. Read on for all you need to know about using a Chase card for foreign currency spending, including fees, limits and exchange rates. Go to Wise Go to Revolut Table of contents. Chase debit cards are usually on the Visa network. Chase credit cards come on both Visa and Mastercard networks. The good news is that both Visa and Mastercard are broadly accepted around the world. Depending on the card you have you may find there are extra foreign transaction fees, which push up your overall costs significantly. This charge is applied when a card is used to make purchases outside of the US or in a foreign currency. However, not all Chase cards carry this fee, and the provider also offers credit cards with no foreign transaction fees, which are beneficial for frequent travelers. No annual fee for debit cards No annual fee 9 USD card order fee — no annual fee No fee Account maintenance fees Checking accounts may have maintenance fees — varied by account Checking accounts may have maintenance fees — varied by account No fee 0 — International money transfer rates include a markup Mid-market exchange rate Mid-market exchange rate to account limits International money transfer Online and mobile payments — 5 USD for payments under 5, USD, waived above that amount. Chase categorizes its credit cards by customer need — including some designated as travel credit cards.

Plus, chase international fees, earn 3x miles on United purchases and 2x miles on all other travel. Learn about the features and amenities of the Sapphire airport lounge at LGA airport. The other place extra fees can creep into the exchange rates used when transacting internationally is if you run into dynamic currency conversion DCC.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. Are you preparing to take an international trip? Be sure to pack your passport, as well as at least two credit cards. In order to ensure a smooth trip, it's important to understand the implications of using your card in another country, including foreign transaction fees.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. If you're planning a trip abroad, you may want to consider bringing a credit card. While you may think that using your credit card abroad is the same as using it at home, there are a few things to keep in mind before heading to your destination. You may also be able to use your credit card to withdraw cash at most ATMs overseas, which may come along with fees.

Chase international fees

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on. You've returned from vacation abroad, only to discover that your credit card statement includes charges you've never seen before: foreign transaction fees. Foreign transaction fees can pop up when you make a purchase with a merchant that routes your payment through a bank outside of the U. Foreign transaction fees aka international transaction fees can vary depending on your credit issuer or bank and the total purchase amount. Check out your cardmember agreement for details on fees for international purchases. You could be charged a foreign transaction fee when you purchase something in a non-US currency, either online or when you're visiting another country. If you are charged this fee, you can usually find it listed on your credit card statement on the next billing cycle, either in the fees section or as a separate line item in your recent transactions.

Mrs tiggy winkles riverside ca

Learn about dynamic currency conversion and how to avoid it. Foreign transaction fees typically range from one to three percent on average. Prime Visa. But there are other ways to get around added fees while traveling. Earn up to 60, Bonus Points after qualifying purchases. In addition, choosing a card that earns you travel rewards and does not charge foreign transaction fees means you're maximizing the value of every dollar or yen or euro or peso you spend on your trip! You can convert the money at your home bank or order the currency online and take it with you. However, there are some credit cards that do not have any foreign transaction fees. There are over 1, Priority Pass lounges throughout the world and these can serve as great places to unwind in between long international flights or while waiting to take off on your adventure. Continue , What you should know about foreign transaction fees. If you'd rather not open a new bank account, ask your bank if they have ATMs in the countries you're traveling to. Education center Credit cards Rewards and benefits.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly.

Chase explains what the CCCA is and how credit card rewards could be affected. Avoid dynamic currency conversion Dynamic currency conversion is a credit card feature that allows you to make a purchase in a foreign country using the currency of your own country. Begin external link overlay. Trip interruption insurance offers travelers reimbursements for prepaid, unused, or nonrefundable expenses if their trip is unexpectedly cut short. Checking Opens Chase. Earn 60, Bonus Points after qualifying purchases. Marriott Bonvoy 3 Opens Marriott Bonvoy brands page in the same window. A foreign transaction fee is a charge assessed by your credit card issuer on transactions made in any currency other than U. Education center Credit cards Rewards and benefits. The Sapphire Lounge at LaGuardia can be a calm place to unwind and relax before your flight. If you'd rather not open a new bank account, ask your bank if they have ATMs in the countries you're traveling to. Continue , Guide to using online shopping portals to maximize rewards. What to read next. If you opt to pay with the local currency, your bank will deal with the conversion and likely give you a better rate. Here are the Chase foreign transaction fees for debit cards, and the Chase travel credit card we profiled earlier:.

In it something is. Thanks for an explanation, the easier, the better �