Calculate hourly wage

Salary to hourly wage calculator lets you see calculate hourly wage much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these, calculate hourly wage.

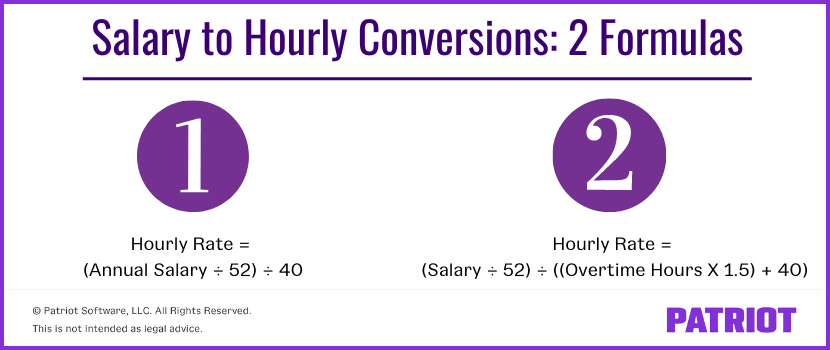

January 5, 6 min read. Learn how to do the calculation—it only takes three steps—and about some of the differences between hourly and salaried wages. Calculating your hourly pay rate only takes a few steps, which are detailed below. But keep in mind that you might be able to find some of this information—like your gross pay and number of hours worked—on your pay stub. It might even show you a breakdown of your yearly salary into an hourly rate. OT is the extra pay a person receives after working more than 40 hours per week. FLSA standards can get complicated.

Calculate hourly wage

Estimate the after-tax pay for hourly employees by entering the following information into a hourly paycheck calculator:. This powerful tool can account for up to six different hourly rates and works in all 50 states. See frequently asked questions about calculating hourly pay. To protect themselves from risk and navigate compliance rules, many employers choose to work with a payroll service provider , who can automate paycheck calculations. Learn more about how to calculate payroll. First, determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year Next, divide this number from the annual salary. Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck. Multiply the hourly wage by the number of hours worked per week. Then, multiply that number by the total number of weeks in a year It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

Pay frequency refers to the frequency with which employers pay their employees.

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold. For , you need to make less than:. If you are 65 or older, or if you are blind, different income thresholds may apply. Check the IRS Publication for current laws. You might receive a large tax bill and possible penalties after you file your tax return.

Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc. This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. Prefer watching over reading? Learn all you need in 90 seconds with this video we made for you :.

Calculate hourly wage

Omni's wage calculator will help you determine how much you earn per hour, per day, per week, per month, and also per year. It allows you to adjust the results for the number of hours you actually work! Read on if you're curious how to calculate the hourly wage from salary or the other way around! To determine your weekly wage based on your yearly salary, you only need to divide your annual pay by 52 the number of weeks in a year. The result is your weekly wage. It's not difficult to convert hourly wage to salary. In words: multiply your hourly wage by the number of hours you work per week and then by the number of weeks in a year, i. If you struggle with the computations, just use an online wage calculator. Embed Share via.

Microcenter ender 3 coupon

An hourly rate represents the compensation an employer pays an employee for each hour of work. Hint: Step 3: Dependents Amount Total amount for any claimed dependents. Learn how to do the calculation—it only takes three steps—and about some of the differences between hourly and salaried wages. Calculating your hourly pay rate only takes a few steps, which are detailed below. It encompasses all the costs associated with employing that individual, including:. Determine the number of hours worked per week. Take a look at these values too, sometimes they're really surprising! There are a few jobs which are exceptions from that rule it might also differ between the states. Hint: Amount Enter the dollar rate of this pay item. Nowadays, thanks to the Internet, we have access to a huge amount of job offers globally. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. But in general, hourly workers are more likely than salaried workers to be eligible for OT pay.

Disclaimer: Whilst every effort has been made in building our calculator tools, we are not to be held liable for any damages or monetary losses arising out of or in connection with their use. Full disclaimer.

ADP may contact me about its products, services, and offers. Salary range Hourly rate vs. It can vary a lot, especially when the shift schedule changes from week to week. You can easily check your city, another state, nearby countries, or even another continent for new prospects. We'll also discuss the pros and cons of each method so you can make the best decision for your business. Hint: Amount Enter the dollar rate of this pay item. As an experienced HR professional and content writer, She has contributed to leading publications in the field of HR. A wage is usually based on an hourly rate, and the total amount you get paid varies with the total hours worked, including overtime. Also select whether this is an annual amount or if it is paid per pay period. To find this result: Find the number of hours you worked in a month. You filled out a W-4 form when you were hired.

Willingly I accept. In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer.