Bpi maintaining balance 2019

Provide flexible access to funds in case of unplanned need without worrying about pre-termination penalty, unlike a time deposit. Withdraw up to 2x a month for free. A minimal fee of Php 18 will be charged for every succeeding withdrawal or debit transaction for the month, bpi maintaining balance 2019. Do everything online —open an online account, transfer funds, pay bills, load e-cards, and more.

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice.

Bpi maintaining balance 2019

Your remittance goes straight to your account which you can access online or through the BPI Mobile app. You don't have to withdraw everything at once. Withthdraw only what you need with no fees. Visit any BPI branch near you. For any product related inquiries or to set an appointment, send us an email at remittancemarketing bpi. You may also visit the nearest BPI branch in your area. A remittance solution where you can remit your hard earned salaries and manage remittances effectively. A savings account that gives free life insurance worth 3X your account balance. Let your dollars grow with us and enjoy maximum convenience in monitoring your account. BPI is a proud member of.

Announcements Get the latest and important updates from BanKo.

For Android : Google Play. For iPhone : App Store. Step 2. Read and accept the Terms and Conditions. Fill out the registration form in the succeeding pages.

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. Learn how you can grow your money to its full potential through investing. Start your investment journey today. Ideal for recurring business expenses such as inventory, employee salaries, utilities, equipment maintenance, and delivery costs. Download the BizLink Mobile App and start creating and approving transactions with just a few taps.

Bpi maintaining balance 2019

Get the best value from all your spending through our various cards packed with exciting deals and features you will love. Make your everyday spending more rewarding. Start enjoying your days of rewards, rebates, and exclusive privileges. Invest today and be ready tomorrow. Let BPI help you reach your dreams with our wide array of investment options and expert financial advice.

Loft bed for adults canada

Who do I contact for questions or inquiries regarding Padala Moneyger? Cashflow Management Back. Passbook Savings for corporate and Business Banking clients. Schedule of Charges Schedule of Charges. About BPI. Who We Are Leadership Awards. About BPI. Ayala Plans, Inc. As the first bank in Southeast Asia, we have established a history of client trust, financial strength, and innovation. Investor Relations.

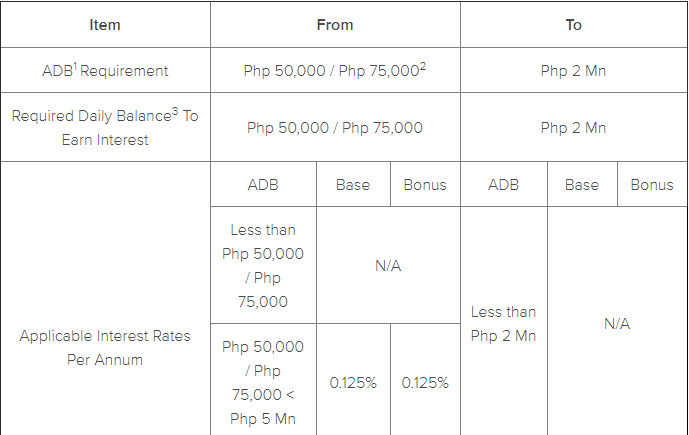

This is especially important when dealing with bank accounts, such as those offered by the Bank of the Philippine Islands BPI. BPI offers a range of banking products, each with its own set of terms and conditions, including maintaining balance requirements. The maintaining balance is the minimum amount that you need to keep in your bank account in order to avoid any penalties or charges.

Bonus rate of 0. Pamana Padala A remittance solution where you can remit your hard earned salaries and manage remittances effectively. This is required to authorize your future financial transactions. Easy To Manage. A savings account that allows you to automatically set asside money regularly while earning higher interest. Use it when you shop here or when you shop online anywhere in the world. Learn More. For inquiries and comments, please contact our BanKo Hotline number at 02 , Mondays to Fridays, am to pm; or send us an email at [email protected]. You are in Personal Banking Personal Banking. Are there service charges for Saver Plus? A remittance solution where you can remit your hard earned salaries and manage remittances effectively. Investor Relations overview BPI grows from strength to strength. Advisory: Shift to electronic statements of account. The BanKo savings account is designed to cater to the needs of the unbanked. Debit Card.

You are mistaken. I can defend the position.

I consider, that you are not right. I am assured.