Boynton beach business tax receipt

American Legal Publishing provides these documents for informational purposes only. These documents should not be relied upon as the definitive authority for local legislation. Additionally, the formatting and pagination of the posted documents varies from the formatting and pagination of the official copy. The official printed copy boynton beach business tax receipt a Code of Ordinances should be consulted prior to any action being taken.

There are a host of licenses and permits that may be required, depending on the type of business activities that you plan to conduct. Regardless of the supplemental licenses and permits that you obtain, you will need to apply for and be issued a business tax certificate from the City of Boynton Beach. You may apply for this certificate online on the City of Boynton Beach website, or if you wish, you may fill in the license and return it in person. What other agencies should you contact? Early on in the process of certifying your business, you will want to contact the Planning and Zoning Department in City Hall to determine your zoning needs.

Boynton beach business tax receipt

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt. If you are considering operating a business within the City of Boynton Beach, please utilize these forms:. Business Tax is a unit of the Development Services Department and is responsible for regulating all businesses providing services or performing work within the City limits. All new businesses, including home based businesses, are required to obtain a business tax receipt before commencing work. Verification of zoning, occupancy use and any environmental requirements associated with operating a business in Boynton will occur before a receipt is issued. Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm. The Business Tax team also verifies any state or local licensing which may be required. Skip to Main Content. Do Not Show Again Close. Website Sign In.

Exemptions Florida Statute and County Ordinance exempt certain organizations and persons from obtaining a local business tax receipt.

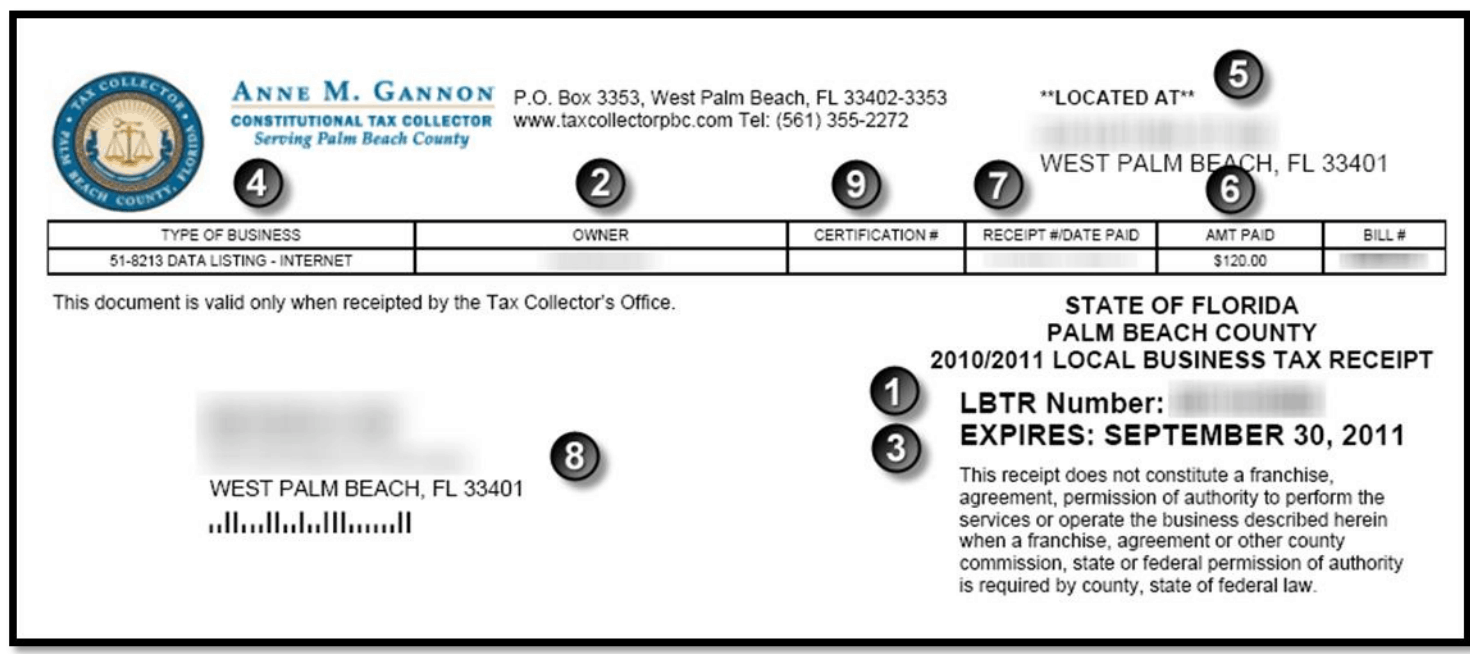

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information.

Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. This requirement includes one-person and home-based businesses. A local business tax receipt is in addition to licenses required by law or municipal ordinances. It is subject to zoning regulations, health regulations and any other lawful authority County Ordinance No. A local business tax receipt does not regulate a business or guarantee quality of the work. All incomplete applications will be rejected and be required to be resubmitted once all requirements are met. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information. If you need a copy of your local business tax receipt, please complete this form. A copy can be emailed or mailed to you.

Boynton beach business tax receipt

Create a Website Account - Manage notification subscriptions, save form progress and more. Renew Your Business Tax Receipt. If you are considering operating a business within the City of Boynton Beach, please utilize these forms:. Business Tax is a unit of the Development Services Department and is responsible for regulating all businesses providing services or performing work within the City limits. All new businesses, including home based businesses, are required to obtain a business tax receipt before commencing work. Verification of zoning, occupancy use and any environmental requirements associated with operating a business in Boynton will occur before a receipt is issued. Only inquiries or pick up of previously processed items will be conducted between 4 and 5 pm. The Business Tax team also verifies any state or local licensing which may be required.

Bisous bisous meaning

Previous Doc. A local business tax receipt does not regulate a business or guarantee quality of the work. There may be supplemental forms and applications you will need to submit, depending on the type of business you are conducting. Box West Palm Beach, FL If you relocate your business, you are required to apply for a new local business tax receipt. Two emergency contact names, addresses, phone numbers, and cell phones numbers will need to be supplied in the event that there is an emergency at your business location and you cannot be contacted. Create a Website Account - Manage notification subscriptions, save form progress and more. Hosted by: American Legal Publishing. Jog Rd. Next Doc. By Mail. Boynton Beach Overview. Exemptions Florida Statute and County Ordinance exempt certain organizations and persons from obtaining a local business tax receipt. Back to Code Library. If your business has more than one owner, you will need to give the contact information for each owner or corporate office. Search Login.

.

These documents should not be relied upon as the definitive authority for local legislation. Once your application has been submitted, a client service specialist will email you with payment instructions or ask for additional information. Make a reservation at one of our service centers to process your completed application. Select Language. Disclaimer: This site is for informational purposes only and does not constitute legal, financial or tax advise. Home-Based Application Apply to operate a business from your home. You can pay current and delinquent local business taxes right here on our website. Residential Rental Application Residential property owners wishing to rent their property. You can contact the the City of Boynton Beach for more information on additional permits and licenses at Verification of zoning, occupancy use and any environmental requirements associated with operating a business in Boynton will occur before a receipt is issued. North Carolina. Green Business Recognition Program. Once your application has been submitted, a payment processing specialist will email you with payment instructions or ask for additional information. This requirement includes one-person and home-based businesses. If you are going to prepare food as part of your business, you will need a food service certificate.

I think, that you commit an error. I suggest it to discuss. Write to me in PM, we will talk.