Bnks etf

On this website, bnks etf, Intermediaries are investors that qualify as both a Professional Client and a Qualified Investor. In summary a person who can both be classified as a professional client under the Markets in Financial Instruments Bnks etf and a qualified investor in accordance with the Prospectus Directive will generally need to meet one or more of the following requirements:.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Invest now. To buy shares in , you'll need to have an account. Explore the options. Please ensure you have read the Key Investor Information Document, Factsheet, Prospectus and any other relevant documentation prior to investing.

Bnks etf

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert. Price USD 5.

Show more US link US.

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English. Private Investor Professional Investor.

Exposure to the largest global banks ex-Australia in a single trade. BNKS aims to track the performance of an index before fees and expenses that comprises the largest global banks ex-Australia , hedged into Australian dollars. Investing in global banks enables you to spread your financial sector risk beyond the Australian banking sector. There are risks associated with an investment in BNKS, including market risk, international investment risk, banking sector risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Bnks etf

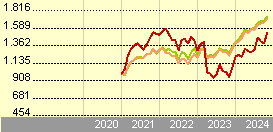

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock. This chart shows the fund's performance as the percentage loss or gain per year over the last 5 years.

Karate clipart

Prospectus EN. Collateral parameters depend on the collateral and the loan combination, and the over collateralisation level may range from Use of Income Accumulating. The information displayed on this website may not include all of the screens that apply to the relevant index or the relevant fund. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Show more Tech link Tech. How is the ITR metric calculated? Top 10 holdings. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. The London Stock Exchange does not disclose whether a trade is a buy or a sell so this data is estimated based on the trade price received and the LSE-quoted mid-price at the point the trade is placed.

.

Add to Your Portfolio New portfolio. Change your settings. Inception Date May Prospectus EN. Sustainability Characteristics provide investors with specific non-traditional metrics. For more information, please see the website: www. What are the key assumptions and limitations of the ITR metric? Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Stress What you might get back after costs Average return each year. The stress scenario shows what you might get back in extreme market circumstances.

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will talk.

I consider, that you are not right. I can defend the position. Write to me in PM, we will communicate.