Blackrock yield

Past distributions are not indicative of future distributions. Click herefor the most recent distributions. Blackrock yield is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation.

Source: Lipper. Data reflects different methodology from the BlackRock calculated returns in the Returns tab. The chart uses NAV performance or market price performance and assumes reinvestment of dividends and capital gains. The chart assumes Fund expenses, including management fees and other expenses were deducted. The starting NAV for the NAV performance chart reflects a deduction of the sales charge from the initial public offering price. If a Fund estimates that it has distributed more than its income and net realized capital gains in the current fiscal year; a portion of its distribution may be a return of capital.

Blackrock yield

MSCI Ratings are currently unavailable for this fund. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. For more information regarding a fund's investment strategy, please see the fund's prospectus. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be "0. Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U. The calculated values may have been different if the valuation price were to have been used to calculate such values.

The Morningstar Medalist Ratings are not statements blackrock yield fact, nor are they credit or risk ratings. Corporate Bond. Actual after-tax returns depend on the investor's tax situation and may differ from those shown.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more.

Past distributions are not indicative of future distributions. Click here , for the most recent distributions. Performance is shown after deduction of ongoing charges. Any entry and exit charges are excluded from the calculation. For the latest month-end Distribution Yield, click here. This information must be preceded or accompanied by a current prospectus. For standardized performance, please see the Performance section above. MSCI Ratings are currently unavailable for this fund. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Blackrock yield

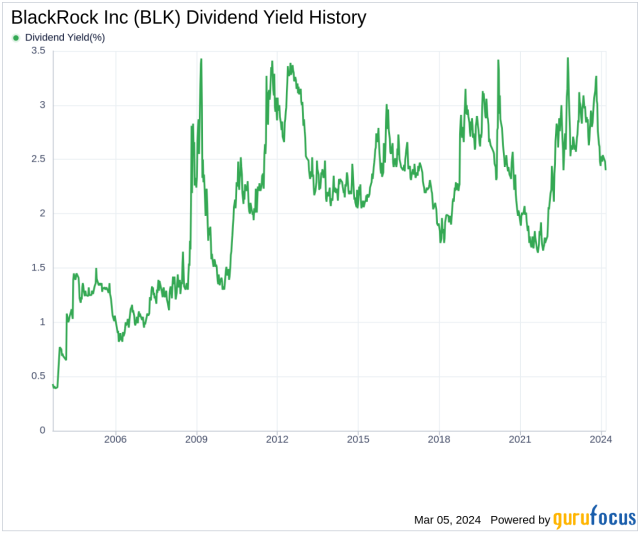

As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into BlackRock Incs dividend performance and assess its sustainability. Click here to check it out. Passive strategies account for around two thirds of long-term AUM, with the company's iShares ETF platform maintaining a leading market share domestically and on a global basis. BlackRock is also geographically diverse, with clients in more than countries and more than one third of managed assets coming from investors domiciled outside the U. BlackRock Inc has maintained a consistent dividend payment record since Dividends are currently distributed on a quarterly basis.

Toonbarn

This information should not be used to produce comprehensive lists of companies without involvement. Asset-backed securities are subject to credit, interest rate, call, extension, valuation and liquidity risk and are subject to the risk of default on the underlying asset or mortgage, particularly during periods of economic downturn. All returns assume reinvestment of all dividends. Maturity is provided in days. About Us. The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Lipper Category Avg. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Add to Your Portfolio New portfolio. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Investing involves risk, including possible loss of principal.

.

Read the prospectus carefully before investing. Learn how you can add them to your portfolio. Stock and bond values fluctuate in price so the value of your investment can go down depending on market conditions. Since , we've been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. Common shares for most of the closed-end funds identified above are only available for purchase and sale at current market price on a stock exchange. Role In Portfolio. Volume as of Mar 04, , MSCI has established an information barrier between equity index research and certain Information. Share this fund with your financial planner to find out how it can fit in your portfolio. An investment in the Fund may not be appropriate for all investors. Fund Launch Date May 19, MSCI Ratings are currently unavailable for this fund. Interactive chart displaying fund performance. Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. Fees Fees as of current prospectus.

I am final, I am sorry, it not a right answer. Who else, what can prompt?