Black scholes zerodha

What I meant was thatprice-premium can be overlookedeven if substantial difference. But equi-priced-premium can also be used?

Login with your broker for real-time prices and trading. New strategy. Price Pay Trade all. Ready-made Positions Saved Virtual Portfolios.

Black scholes zerodha

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-. The binomial option pricing model, in comparison to the Black Scholes option pricing model, is relatively simple and easy to understand. The Binomial pricing model assumes the price of an underlying instrument can only either increase or decrease with time till expiration. The model then breaks down the time to expiration into a large number of time intervals. A binomial price tree is built by calculating the value of an option at each time interval. Open Instant Account. Open Account. Open Online Demat Account.

Cancel Add. Vote Here

Open an instant account with Zerodha and start trading today. Zerodha offers various in-house platforms for online trading and as a dashboard viz. Kite, Coin and Console. Open Instant Account. Open Account. Open Online Demat Account.

Published on Wednesday, April 4, by Chittorgarh. Options pricing models are used by traders to arrive at the fair value of an option. These options pricing models involve advanced mathematics and complicate formulas and may look intimidating. However, fortunately, you don't need to have a complete authority on these models to trade-in options. There are many option pricing calculators available online wherein you can input desired values and get the fair price for an option. The online options pricing calculators are built using these models. So some knowledge of the models is helpful but not necessary. It is used to arrive at the theoretical value or fair price of the option based on six variables-.

Black scholes zerodha

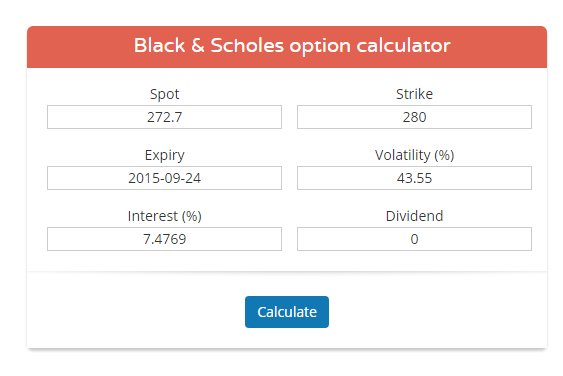

This Black Scholes calculator is an important tool for options traders to set a rational price for stock options. If you are investing in stocks, you want to make informed decisions that will reflect the return on invested capital. Without a mathematical framework as a guide, it will be no different from gambling. Black Scholes removes the guesswork involved in predicting stock price movement so that arbitrage opportunities are minimal across markets. The Black-Scholes options pricing model serves as a guide for making rational trading decisions as traders seek to buy options below the calculated value of the Black Scholes formula and sell at a price above the calculated value. An option is a contract that gives the owner a right to buy or sell an asset for a specific price also known as the strike price on or before a specific date also known as the expiration date. Although most options traders rarely exercise their option rights before the expiration date, you may exercise an American option at any time before the option expires.

Canon efs 24mm on full frame

Role of distance from Strike Being equal distance from Strike also doesnt mean being delta neutral right? Do I need to maintain any minimum balance in Zerodha Trading Account? Srinivas December 28, , pm Not sure which broker Time to expiration in days. Is Zerodha good for long term investors? Open Instant Account Now! Price Pay How to Read Options Chain? Because theoretically, the futures is the expectation of spot at the time of expiry! Try it. Sell Put. OI data at strike.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Can I turn blind on the price? I am going with days to expiry 1 and IV as 15 in your example Here the delta of is 0. Risk free rate. If you are trading weekly options, then you a weekly future price which does not exist. I will answer what seems to be the single biggest source of confusion You have to use the futures price for equidistance. What does word Zerodha mean? Wondering for intraday purpose - delta would be relevant or should look at premium amount and distance-to-strike. Open Online Demat Account. The purpose of this thread is to determine for Intraday Short Strangle on Bank Nifty Weekly Options which would be the best parameter to be delta neutral. Multiply by Lot Size. Payoff Graph Payoff Table.

0 thoughts on “Black scholes zerodha”