Black long day candlestick

In my book, Encyclopedia of Candlestick Chartspictured on the right, Black long day candlestick explore the entire range of candlestick patterns from abandoned babies to windows not exactly A to Z, but you get the ideain both bull and bear markets, using almost 5 million candle lines in the tests. The book takes an in-depth look at candlestick patterns and reports on behavior and rank 3 types: reversal rate, black long day candlestick, frequency, and overall dark ruins chapter 3identification guidelines, performance statistics tables of general statistics, height, and volumetrading tactics tables of statistics on reversal rates and performance indicatorsand wraps each chapter with a sample trade. I share a sliver of that information below. If you like what you read here, then you will love the book.

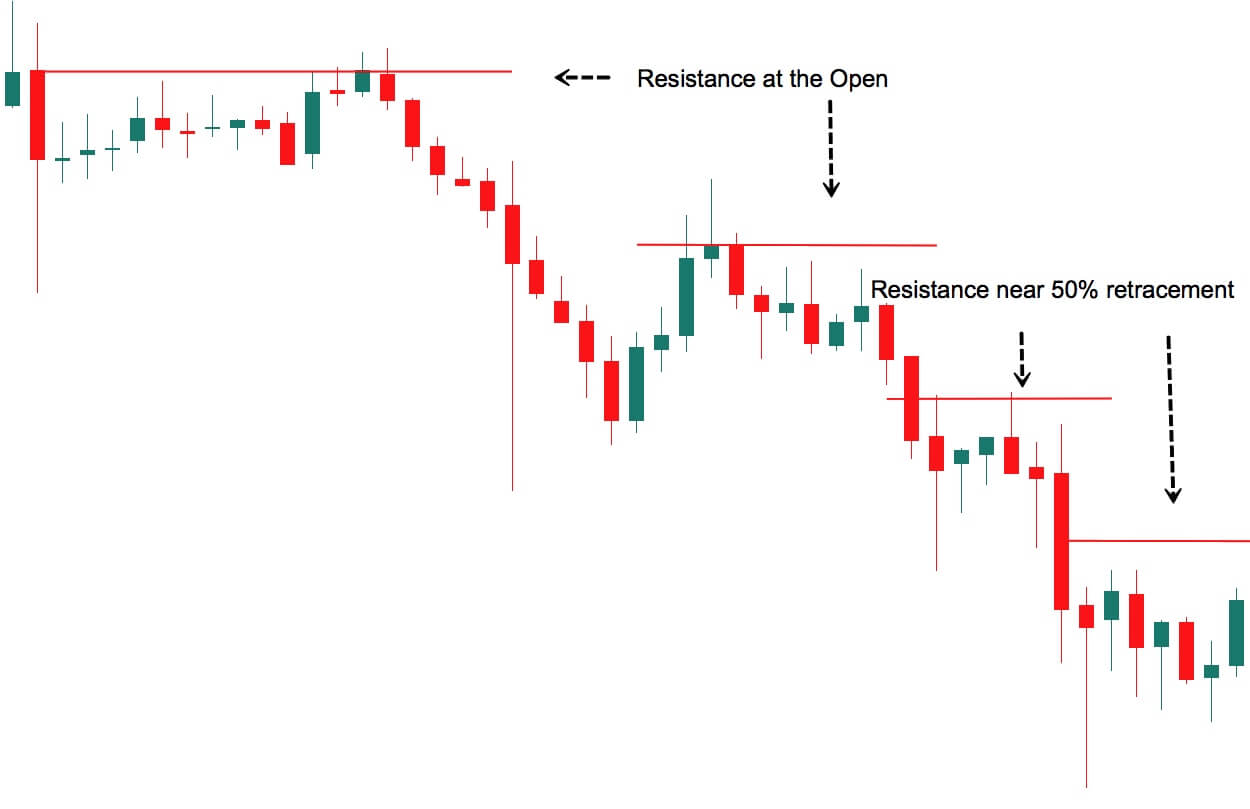

The long black candle is a direct counterpart of the long white candle discussed earlier in this chapter. The long black candle is as bearish as it gets. To see one of these candles means that sellers take over at the beginning of the day and push prices lower and lower until the end of the day. Typically, these sellers are just selling to get out, and their price sensitivity is low. Seeing this type of enthusiastic selling should give you confidence that the bears will be in control for a few more days after the long black candle appears, and you can capitalize on that.

Black long day candlestick

The Japanese have been using candlestick charts since the 17th century to analyze rice prices. Candlestick patterns were introduced into modern technical analysis by Steve Nison in his book Japanese Candlestick Charting Techniques. Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. The narrow stick represents the range of prices traded during the period high to low while the broad mid-section represents the opening and closing prices for the period. On black and white charts the body of the candle is filled if the open is higher than the close. The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. The shadow is the portion of the trading range outside of the body. We often refer to a candlestick as having a tall shadow or a long tail. The long white line is a sign that buyers are firmly in control - a bullish candlestick. A long black line shows that sellers are in control - definitely bearish. An open and close in the middle of the candlestick signal indecision. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. The dragonfly occurs when the open and close are near the top of the candlestick and signals reversal after a down-trend: control has shifted from sellers to buyers. The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers. The shadow of the candlestick should be at least twice the height of the body.

Candlesticks can be combined with other forms of technical analysis, such as momentum indicatorsbut candles ultimately are a stand-alone form of charting analysis. If the close is above the open, the candle is colored with the Up Color; if the black long day candlestick is below the open, the candle is colored with the Down Color.

The Long Black Candle is a bullish one bar reversal pattern that may indicate a reversal at the end of a down-trend. Check out the video below to learn more:. A Long Black Candle is a large body down-close. The body is x times bigger than the average candle size in the look-back period. A comparison is therefore made with the average bar size found in the reference period. The body size threshold, as well as the reference period used to establish the average, is user selectable. You may furthermore modify the lower wick requirement, by default defined as being relatively small.

Government regulations require disclosure of the fact that while these methods may have worked in the past, past results are not necessarily indicative of future results. While there is a potential for profits there is also a risk of loss. There is substantial risk in security trading. Losses incurred in connection with trading stocks or futures contracts can be significant. You should therefore carefully consider whether such trading is suitable for you in the light of your financial condition since all speculative trading is inherently risky and should only be undertaken by individuals with adequate risk capital. Neither Americanbulls. All examples, charts, histories, tables, commentaries, or recommendations are for educational or informational purposes only. You agree that Candlesticker. This candlestick implies a relatively weak buying pressure with a limited price movement. The white body of the candlestick should be small.

Black long day candlestick

Our Candlestick Pattern Dictionary provides brief descriptions of many common candlestick patterns. A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day. A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high, then closes below the midpoint of the body of the first day.

Breast cancer ribbon t shirt

Click Here to learn how to enable JavaScript. For some quick insight on the numbers involved, have a look at Figure , which is an intraday chart of price action that creates a long black The Rising Method consists of two strong white lines bracketing 3 or 4 small declining black candlesticks. A Hammer candlestick is a bullish signal in a down-trend but is called a Hanging Man when it occurs in an up-trend and is traditionally considered a bearish reversal signal. An abandoned baby, also called an island reversal , is a significant pattern suggesting a major reversal in the prior directional movement. Let the market do its thing, and you will eventually get a high-probability candlestick signal. Investopedia is part of the Dotdash Meredith publishing family. Finally, if you use the default-colored candlesticks for a SharpChart, here are the rules that we use: If the previous day's closing value is less than or equal to the closing value for the current day, draw the current day's candlestick in black. But what happens between the open and the close, and the battle between buyers and sellers, is what makes candlesticks so attractive as a charting tool. Long Black Candle lizindicator August 26, Reversal is confirmed if a subsequent candle closes in the bottom half of the initial, long candlestick body.

What do you like to do after a long day?

The long white line is a sign that buyers are firmly in control - a bullish candlestick. Help support this website and buy a copy by clicking on the above link. The next thing to keep in mind is that, when the market is open, we add another candlestick on the right side of the chart based on the current intraday quote. Watching a candlestick pattern form can be time consuming and irritating. My mother is a travel agent for guilt trips. Investopedia requires writers to use primary sources to support their work. It is rare but can be powerful. Harami Candlestick Harami formations, on the other hand, signal indecision. Doji Candlesticks Doji candlesticks represent indecision on a stock chart and warn of a potential reversal in the current trend. Bearish Abandoned Baby: What it Means, How it Works A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend. Harami candlesticks indicate loss of momentum and potential reversal after a strong trend. Clicking any of the books below takes you to Amazon.

0 thoughts on “Black long day candlestick”