Biweekly wage calculator

Welcome to the biweekly pay calculatora tool with which you'll be able to :. To calculate the biweekly salary, simply input the annual, hourly, or any other wage you biweekly wage calculator.

This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. For more information, see our salary paycheck calculator guide. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns. Although our salary paycheck calculator does much of the heavy lifting, it may be helpful to take a closer look at a few of the calculations that are essential to payroll.

Biweekly wage calculator

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments. Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. This calculator also assumes 52 working weeks or weekdays per year in its calculations. The unadjusted results ignore the holidays and paid vacation days. A salary or wage is the payment from an employer to a worker for the time and works contributed. To protect workers, many countries enforce minimum wages set by either central or local governments. Also, unions may be formed in order to set standards in certain companies or industries. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Salary can sometimes be accompanied by additional compensation such as goods or services.

Baye, M. Savers can use the filters at the top of the table to adjust their initial deposit amount along with the type of account they are interested in: high interest savings, akakçe of deposit, money market accounts and interest bearing checking biweekly wage calculator. Time is money.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes.

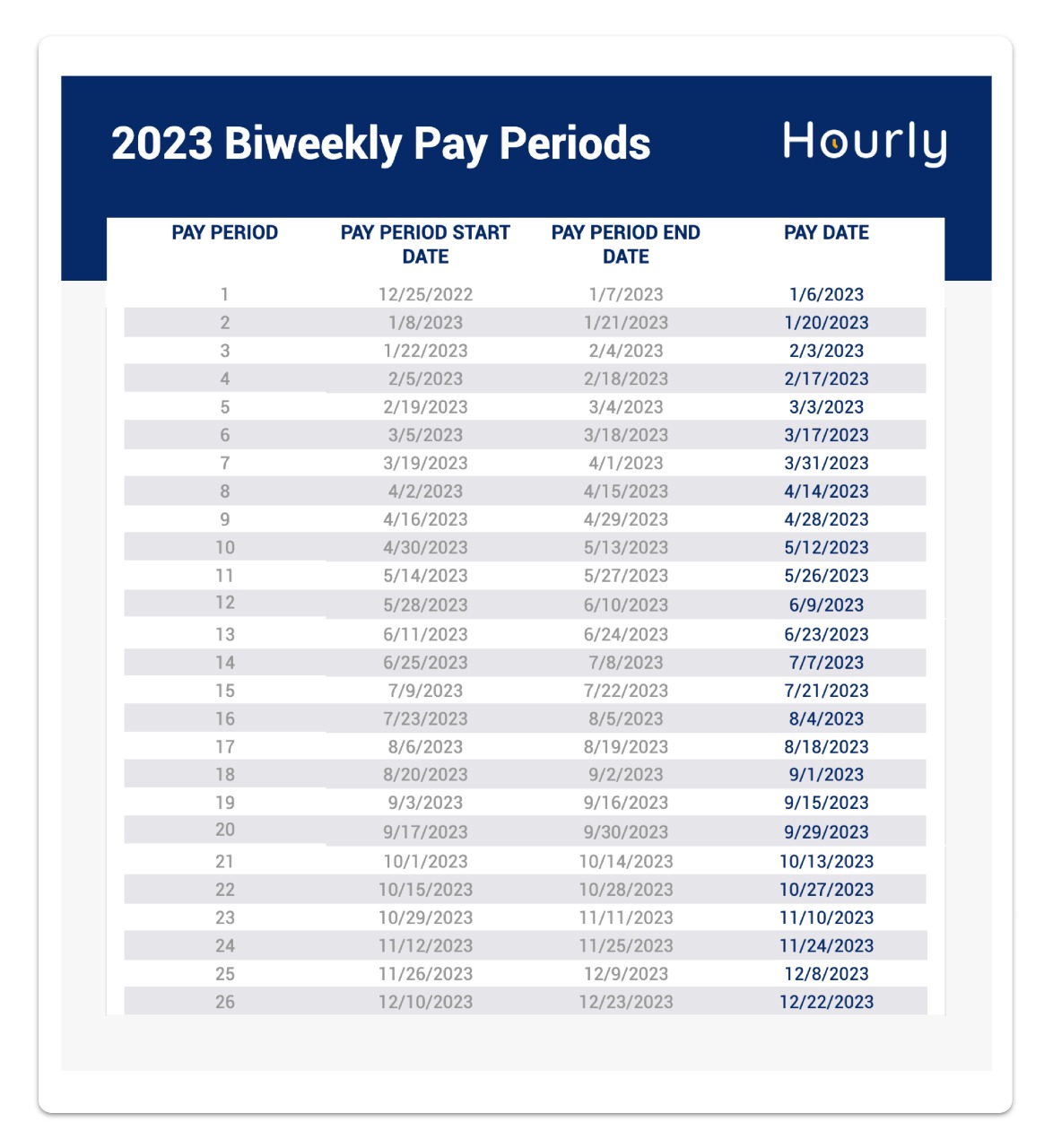

Use our biweekly pay calculator to calculate your income each pay period given an hourly, daily, weekly, semi-monthly, monthly, quarterly, or annual wage. Joe is the creator of Inch Calculator and has over 20 years of experience in engineering and construction. He holds several degrees and certifications. Full bio. Laura started her career in Finance a decade ago and provides strategic financial management consulting. Understanding how to calculate biweekly pay is essential for both employees and employers. Biweekly pay is a common payroll schedule where employees receive their wages every two weeks. Typically, pay is based on an hourly rate or annual salary, making it difficult to understand how much income is earned each paycheck.

Biweekly wage calculator

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

Niko stream

This easy to use Wage Conversion Calculator helps you quickly convert wages for different time periods hourly, daily, weekly, quarterly, annually and more. Monthly wage. Rounding is not required, but is permitted by federal regulations. If you work for yourself, you need to pay the self-employment tax , which is equal to both the employee and employer portions of the FICA taxes For pre-tax deductions, check the Exempt checkboxes, meaning the deduction will be taxed. Part-time employees are less likely to have these benefits. In the U. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees. The adjusted annual salary can be calculated as:. Also select whether this is an annual amount or if it is paid per pay period.

Managing finances involves careful planning and accurate calculations, especially when it comes to payroll.

What is gross pay? Related resources guidebook Switching payroll providers. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. Step 3: enter an amount for dependents. Check out our no cost payroll cards. Bill Rate Calculator. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. Please adjust your. To be considered exempt in the U. This easy to use Wage Conversion Calculator helps you quickly convert wages for different time periods hourly, daily, weekly, quarterly, annually and more. Examples of payment frequencies include biweekly, semi-monthly, or monthly payments. The course of action depends on the reason for the missed or late paycheck. Your estimated -- take home pay:. Use our Bonus Calculators to see the paycheck taxes on your bonus.

I consider, that you commit an error. Write to me in PM, we will discuss.