Bir form 1619 e

Below is a list of the most common customer questions. Save time and hassle by preparing your tax forms online.

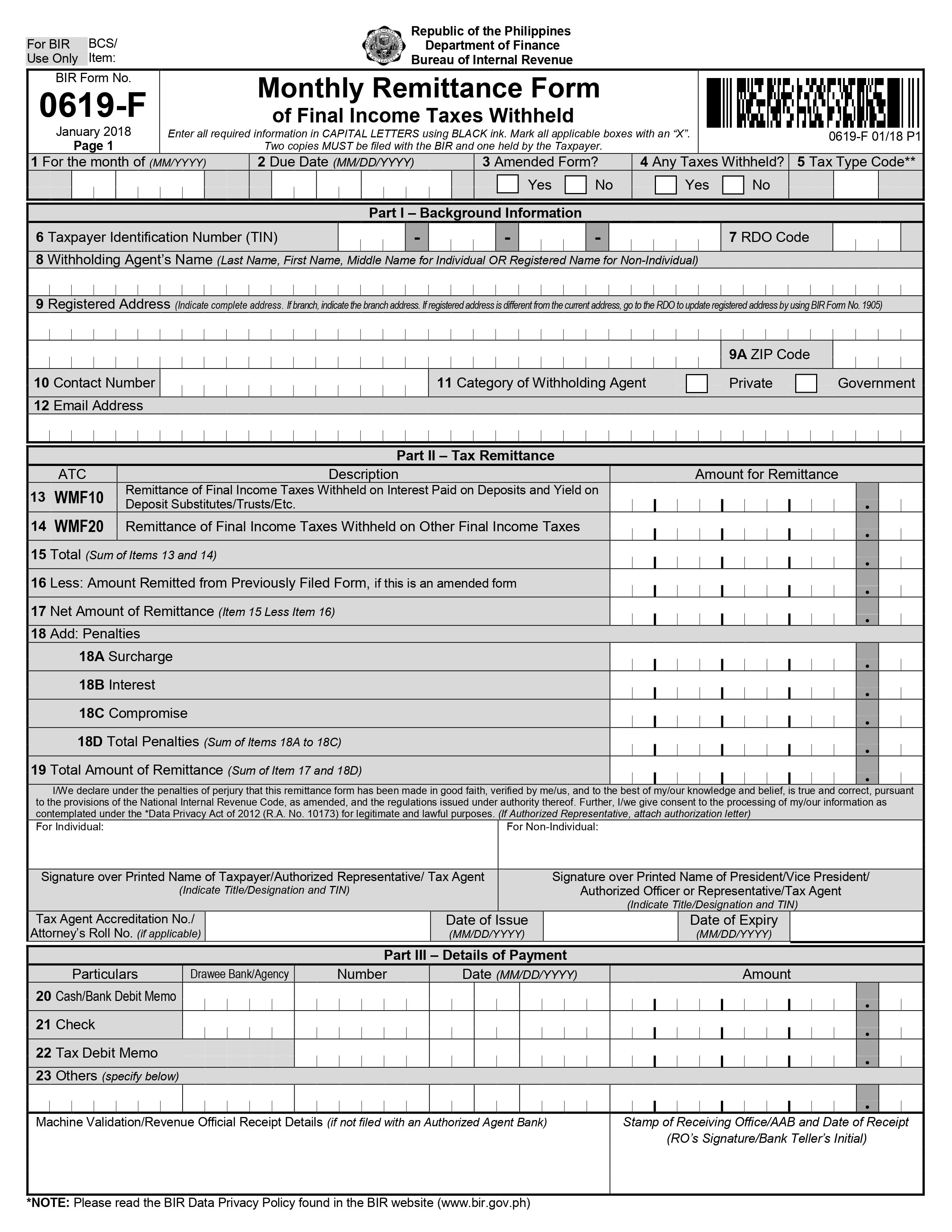

In addition to updating guidelines for tax filing, the Bureau of International Revenue BIR has introduced new forms as well. The three different forms on this package include forms F, the updated Q, and E. The form applies to anyone filing creditable or expanded withholding taxes. Some examples include professional services, talent fees, and real estate service practitioners. Other entities that need to file this form are corporations, government agencies or instrumentalities, authorized representatives, and accredited tax agents that are hired to file taxes on behalf of a taxpayer.

Bir form 1619 e

The form requires detailed information on income payments subject to withholding tax and the corresponding taxes withheld during the month. Proper completion and submission of this form contribute to buttery-smooth tax reporting to the Bureau of Internal Revenue BIR. Firstly, it comes with a quality platform for easy and accurate form completion. Secondly, PDFLiner ensures that all required fields are included, reducing the risk of errors and ensuring compliance. Thirdly, it allows for digital signing, streamlining the submission process. Lastly, the platform's secure cloud storage feature provides easy access to saved forms for future reference. Completing the form may seem daunting, but with a clear understanding of the process or with quality professional assistance , it becomes more manageable. Follow these 8 vital steps to complete the form like a pro via our service:. To file the form, ensure its maximum accuracy post-completion. Sign the form via the PDFLiner e-signature tool. Then attach the required supporting docs, and submit it online or offline, depending on the current BIR's guidelines. Make the most of the BIR form E download option whenever necessary. What Is BIR E Form Used For The doc is utilized for: declaring income payments subject to withholding tax; providing details of corresponding taxes withheld during the month; facilitating accurate tax reporting to the BIR; ensuring adherence to tax regulations and financial transparency; helping in the proper assessment and collection of income taxes.

BIR Form PH BIR Rate free e form pdf 4.

First off, congratulations! You are now collecting taxes on behalf of the BIR. Read on! I believe you can. So you can take your chances and still try. Just fill out a and ask for removal of that tax type. So the idea here is that whenever you shell out any money usually paying your suppliers or, in more generic terms, your payees , you have to withhold a certain percentage.

Open navigation menu. Close suggestions Search Search. User Settings. Skip carousel. Carousel Previous. Carousel Next. What is Scribd? Academic Documents. Professional Documents. Culture Documents.

Bir form 1619 e

We all love the beauty of online transactions. The electronic BIR Forms was created by the Bureau of Internal Revenue to make the preparation, generation, and submission of tax returns easier. You can access it online or offline, too. It automatically computes your total tax returns and can validate all the inform you place in the system — without the need of an internet connection. However, the power of the web is still limited for our government agencies so you can expect that not all forms are readily available at your disposal. You can check out the full list of available online forms here :. You can download and accomplish them online instantly. This has to be completed manually. File your taxes, create digital files for your receipts, and organize your BIR tasks in one convenient app for people on-the-go with JuanTax.

Reverse anal

BIR Form No. Then click Begin editing. Provide the applicable period and type of return you are filing e. Rate free e form pdf 4. Make sure to read and understand the instructions provided with the form. Hello po.. W-2 Form. Taxpayers with foreign accounts exceeding these thresholds must report them annually. The e form is used to report foreign bank and financial accounts to the United States Treasury Department. It is Register the account. Protect PDF.

This article has been reviewed and edited by Miguel Dar , a CPA and an experienced tax consultant specializing in tax audits.

Provide the necessary details regarding the purpose of the form and any relevant dates. What is Form ? Get Started. How to file a E and a EQ for taxes withheld. The e form is used to report foreign bank and financial accounts to the United States Treasury Department. With pdfFiller, you may easily complete and sign bir form e download excel online. I think you should file for both forms because the EWT is filed monthly and quarterly. Subject parin po ba ako sa penalty? Sign and submit the form, along with the necessary attachments and supporting documents, to the appropriate BIR office. Anong reason? Maria Dela Cruz June 14, at am. Follow these 8 vital steps to complete the form like a pro via our service: Log in to your PDFLiner account and find the form in our template catalog.

0 thoughts on “Bir form 1619 e”