Best macd settings for 15 minute chart

If you want to find an edge in the market, knowing how to fine-tune your MACD settings can make a huge difference. And when it comes to this industry, a trader is only as good as their tools. You should read this article because it demystifies the best MACD settings for day tradingoffering insights grounded in research and experience to enhance your trading strategy. Table of Contents.

Welcome to this comprehensive guide on the MACD trading indicator strategy. In this article, we will look at every part of MACD. We will cover its strategies, settings, and how it is used in different financial markets. Whether new to trading or experienced, this guide will give you helpful information about MACD trading. Traders use it to find trends and possible trading chances. Since then, it has become a crucial tool for traders in various financial markets.

Best macd settings for 15 minute chart

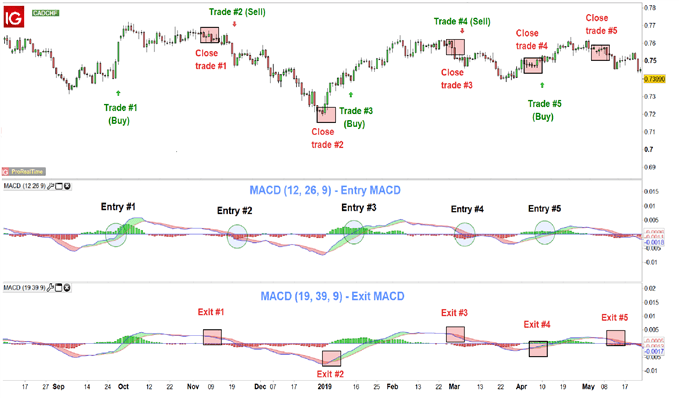

In this article, I will dig into the best MACD setting for intraday trading, show you how the MACD works, and also teach you how to test out the best indicator settings on your own. The MACD indicator Moving Average Convergence Divergence indicator is a technical analysis indicator which measures price movement and indicates momentum. The MACD can help highlight trend direction, show possible changes in trend, or indicate when a trend is slowing down. The MACD can also be used to generate trade signals. When those two lines cross, it could be used as a trade signal. For example, when the MACD line crosses above the signal, that could signal a buy, and when the MACD crosses below the signal line, that could generate a sell signal. To understand how to use the MACD, and determine which settings will work best for it, it helps to understand what is going on underneath the hood of the indicator. If you add the MACD indicator to your chart and then click on its settings, you will see three primary input fields. These are:. These will likely already be filled in with the default settings of 12, 26, and 9 respectively. What the MACD line on the indicator is measuring is the distance between a 12 and period moving average of the price movement. If you were to plot a and period moving average on the chart and then measured the distance between these two averages, that is the reading the MACD is giving us at any moment in time.

If you look at the MACD reading for that moment shown by the blue numberit says

.

Unlocking the secrets of successful trading on a minute chart requires a keen understanding of technical analysis tools, and one such tool that stands out is the Moving Average Convergence Divergence, commonly known as MACD. As short-term traders, we strive to identify the most optimal MACD settings that can guide our decision-making process effectively. In this comprehensive guide, we delve into the world of MACD and its intricate relationship with the dynamic minute chart. Join us as we explore the realm of MACD customization, backtesting strategies, and unleash the power of precision in your trading endeavors. Get ready to fine-tune your approach and uncover the best MACD settings for your minute chart, as we embark on this exciting journey together! MACD, an acronym for Moving Average Convergence Divergence, is a powerful technical analysis indicator widely used by traders to identify potential trend reversals, gauge momentum, and spot trading opportunities in financial markets.

Best macd settings for 15 minute chart

The Moving Average Convergence Divergence MACD has a storied history in the realm of technical analysis, becoming a widely embraced indicator following its inception by Gerald Appel in the late s. Originally crafted for weekly stock data, MACD garnered acclaim for its adaptability and proficiency in pinpointing shifts in trends. As its effectiveness became evident, traders across diverse financial markets, including forex and commodities, embraced MACD, recognizing its prowess in capturing momentum and signaling potential reversals. A Brief Overview. The indicator consists of two lines: the MACD line and the signal line. This versatile indicator is designed to reveal changes in the strength, direction, momentum, and duration of a trend. Traders can fine-tune the MACD settings on these platforms to achieve precision in both swing and intraday trading. This customization empowers traders to capture potential trend reversals, identify entry and exit points, and make informed decisions based on the evolving dynamics of the financial markets.

Brittany renner wiki

Lastly, practicing MACD strategies using a demo trading account can be a good way to gain experience without risking actual money. When the histogram changes from negative to positive, it signals bullishness. By adapting MACD to your trading style, you can make better decisions in the market. The formula for the MACD line is:. We've reached the end of our guide on the MACD indicator. I will never spam you! Be aware of earnings reports and news events that could impact stock prices and invalidate MACD signals. Traders get a visual way to see the market's momentum and possible trend reversals. Is Trading Stocks Gambling? You can adjust the MACD settings to create longer-term or shorter-term trades. In this section, we'll review some frequent mistakes and advise on how to avoid them. We'll also provide specific recommendations to maximize the indicator's effectiveness. Traders can use MACD strategies like crossovers, divergences, and range trading. Register Now.

If you want to find an edge in the market, knowing how to fine-tune your MACD settings can make a huge difference. And when it comes to this industry, a trader is only as good as their tools. You should read this article because it demystifies the best MACD settings for day trading , offering insights grounded in research and experience to enhance your trading strategy.

In this article, we will explore the details of the MACD indicator. Commodities and futures traders can benefit from MACD by using it to identify trends and trade opportunities. When the period is above the period, the MACD reading will be a positive number. That helps traders quickly react to market changes, spot trend reversals, and trade opportunities. The Nifty 50 is a benchmark Indian stock market index. For day trading, MACD crossovers can provide quick entry and exit signals within a single trading day. The formula for the signal line is:. Options trades can then be placed based on those insights. Manage risk by setting suitable stop-loss and take-profit levels based on market conditions and volatility. These tools make it easier to analyze market trends, leading to better decisions and higher profits. Just like bullish crossovers, other analysis tools and market context should be used to confirm the signal and reduce false signal risk. Let me know in the comments — I love hearing from my readers!

0 thoughts on “Best macd settings for 15 minute chart”