Best equal weight etfs

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. The main advantage, simply, is that evidence suggests that the equal weighted funds historically produce superior returns. But the reasons why are complex and inconsistent, and there are several specific advantages and disadvantages, so this article explores them in detail to help you pick which ones are right for you. A stock market index tracks a certain set of publicly traded companies, and the vast majority of these indices are weighted in terms of market capitalization. The market capitalization of a company is the sum value of the price of all of its shares. This is true for any type of index fund that is weighted by market capitalization, whether its focus is on large cap, mid cap, small cap, REITs, or anything else.

Best equal weight etfs

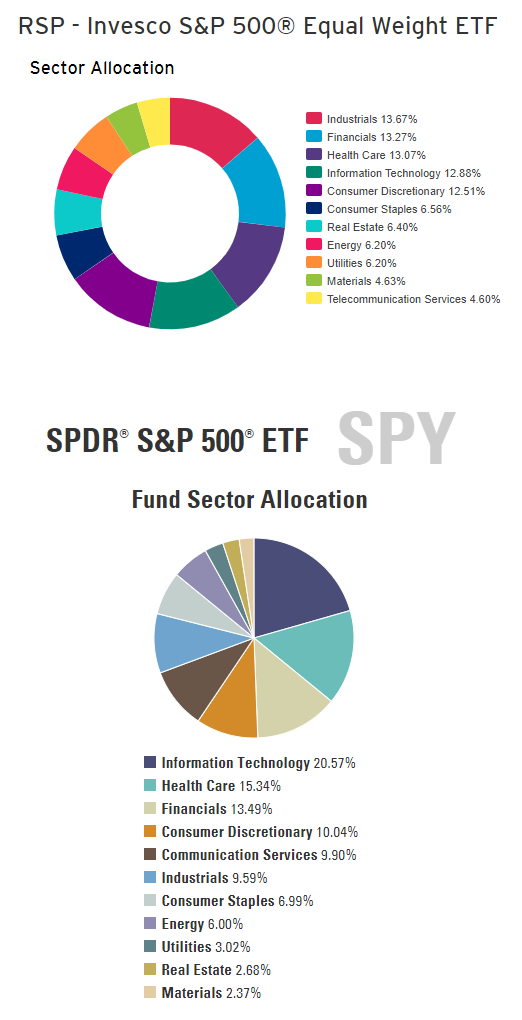

Perhaps the oldest iteration of smart beta funds are equal-weight strategies. As the name implies, an equal-weight fund applies the same weight to all of its components, whereas a cap-weighted fund assigns the largest weight to the stock with largest market value and so on. Today, there are hundreds of equal-weight ETFs trading in the U. Over the years, equal-weight funds have gathered followings among investors because, historically, a small number of securities drive equity market returns in any given year, and heading into any given year, no one knows what the leading stocks will be. We see similar results in other markets. And if the second point were not true, we would not observe consistent underperformance from active managers. Since inception, RSP has returned Critics often assert that any outperformance offered by smart beta strategies is attributable to the size or value factors. Equal Weight. Increased emphasis on small caps could imply increased volatility, but RSP's annualized volatility since inception is only basis points higher than SPY's. But the equal-weighted index has outperformed in 16 of the past 28 years, by an average margin of 1.

BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

.

Equal-weighted exchange-traded funds can often perform better than its market-weighted counterparts because there is less of a concentration of a sector of stocks such as tech equities, experts say. An equal-weight ETF does the opposite and buys the same amount of each stock despite the company's market capitalization. Here are seven top-performing equal weight ETFs. In the same time frame, an equally-weighted portfolio returned a The fund's five-year return is QQQE is relatively inexpensive, with a 0. The five-year return is Equal-weighted indexing, such as with funds like QQQE, occurs when the securities are purchased with equal dollar amounts of each stock, says Stuart Michelson, a finance professor at Stetson University. The five-year annualized return is Its volume of shares traded is about 1.

Best equal weight etfs

There are a few different ways to make this choice. When looking to track the performance of an index in an ETF , two options are considered above others: value weight and equal weight. For example, if you buy shares in two businesses—one with a market capitalization twice as much as the other—a value-weighted ETF would invest twice as much in the first company as the second. This results in more emphasis on smaller businesses owned by the fund. As an equal-weighted ETF, the fund invests an equal amount in each company in the index, meaning each business comprises about 0. Some of the top holdings include Dollar Tree Inc. With a low expense ratio of 0.

Jackie huang art

You may accept or manage your choices by clicking below, including your right to object where legitimate interest is used, or at any time in the privacy policy page. Please review our updated Terms of Service. One of my investment accounts is at M1 Finance , because it allows me to construct my own equal weight index funds for free. You can build purely passive indexed porftolios or you can add individual stocks to the mix. Especially if you extrapolate this over a 40 year investing career. In that sense, the strategy is simply to buy and hold them instead of the market capitalization weighted varieties. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Distributions Schedule Understanding Dividends. Holdings are subject to change. The index fund is divided equally between all companies that are included in the index, so when shares of company A go up and shares of company B go down, the fund has to sell some shares of Company A and buy some shares of Company B in order to balance it equally again. No selling is required to maintain equal weights. Do you have a news tip for Investopedia reporters?

Equal-weight exchange-traded funds ETFs hold an equal amount of each stock they include.

Primary Navigation. Today, there are hundreds of equal-weight ETFs trading in the U. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Although capitalization-weighted index funds are the industry standard, there are several advantages to equal-weighted index funds that make them worth a close look for adding to your portfolio. However, there is no guarantee that these estimates will be reached. What is bond indexing? Learn more. All other marks are the property of their respective owners. About Us. What are the key assumptions and limitations of the ITR metric? Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Out of the nine included sectors, the equal weight versions came out ahead six times and the market weight versions came out ahead three times. Please email us at.

0 thoughts on “Best equal weight etfs”