Best asx dividend shares

Reader: "Is one of very few places an investor can go and not best asx dividend shares product rammed down their throat. Love your work! Reader: "Keep it up - the independence is refreshing and is demonstrated by the variety of well credentialed commentators. Stands above all the noise.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Best asx dividend shares

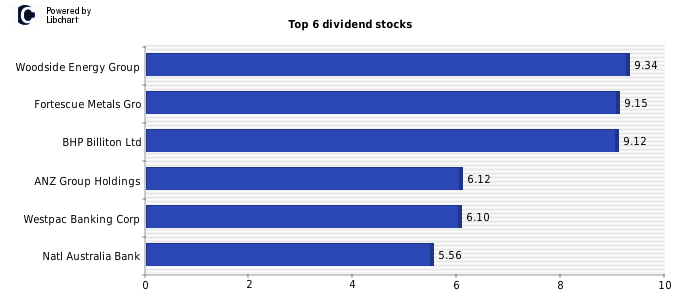

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. With interest rates as high as they are and the best savings accounts delivering 5. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. But if you do some digging, you'll find other great dividend payers in other market sectors. Typically, the companies that will pay you the best dividend yields are the ASX large-cap shares. Most of them have been operating for decades, bringing in sustainably strong earnings every year. Let's look at which ASX large-cap shares are trading on the highest trailing dividend yields today. If you're using this data to research ASX dividend shares , just remember that trailing dividend yields represent last year's earnings as a percentage of today's share price. This is particularly the case with mining stocks, oil shares and any other stock associated with commodities. These companies negotiate the sale prices for their products based in large part on the going global market commodity price at the time. Commodity prices are entirely out of these companies' hands. When they're high, mining and oil shares are likely to earn more and pay higher dividends. When they're low, the reverse happens.

I am closely watching the Lithium push on this front.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. If you want some high quality options in your income portfolio , then it could be worth checking out the ASX dividend stocks listed below. That's because they have been named as best buys by brokers in March. Here's what they are saying:. Bell Potter thinks that this healthcare property company could be a great option for income investors.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed.

Best asx dividend shares

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. ASX dividend shares are in the spotlight in today's ultra-low interest rate environment. That means we're unlikely to see higher returns from any cash held in savings deposits for some time yet. It also means investors seeking regular income — and willing to take more risk with their money than sticking it in a bank — increasingly look to ASX dividend shares. They hope that these will not only return inflation-beating yields but will deliver some capital gains as well.

Truist near me

Learn More If you want some high quality options in your income portfolio , then it could be worth checking out the ASX dividend stocks listed below. Featured Partner. Morningstar Direct. Shares The standout winners from February reporting season The IT, consumer discretionary and real estate sectors were the winners from the recent reporting season, but there were disappointing earnings from miners, and the likes of Corporate Travel Management and Harvey Norman. Aurizon ASX:AZJ This company has had its ups and downs though it may finally be getting its act together and its rail assets remain attractive. Reader: "It's excellent so please don't pollute the content with boring mainstream financial 'waffle' and adverts for stuff we don't want! We recently published a team post, Top ASX shares to buy in instead of investing in a term deposit. Kaye Fallick 6 March Yields can be deceptive if dividends are cut in future. Savings only pay a yield. Dividends paid by many ASX large-cap shares carry franking credits , which reduce an investor's tax liability.

Our analysts weigh in on their future dividend prospects. In a recent article I tried to answer a question I hear frequently.

Why We Picked It Whitehaven Coal Ltd, a leading Australian coal mining company, focuses on exploring, developing, and producing high-quality thermal and metallurgical coal. The stock should benefit from strong population and ecommerce growth, and significant potential upside comes from future development of its unused landbank. Hi Tom, Yes, it was a contender for the list, and was in my prior week's article on stocks to hold forever. Forbes Advisor adheres to strict editorial integrity standards. The ASX bank shares and mining shares are well-known for delivering some of the highest dividend yields in the market year after year. Start Investing. There are two key reasons: ASX shares offer the possibility of capital growth as well as yield. Latest Updates Shares 11 ASX dividend stocks for the next decade What are the best stocks to own that can pay regular dividends and beat indices on a total return basis in the long-term? The criteria My goal for the dividend stocks is that each of them should provide resilient annual income and perform better than the ASX index including franking credits over a year period. As always, consult with a financial advisor before making significant investment decisions. Despite the climate change push, we still need Oil and Gas and will do for many years to come.

Let's talk on this theme.

Excuse, it is removed