Bankrate mortgage loan calculator

The cost of a loan depends on the type of loan, the lender, the market environment, bankrate mortgage loan calculator, your credit history and income. Secured loans require an asset as collateral while unsecured loans do not. Common examples of secured loans include mortgages and auto loans, which enable the lender to foreclose on your property in the event of non-payment.

These funds go directly to the purchase of the home, and can come from your savings, a gift from family or a friend, proceeds from the sale of another home, grants and other sources. This calculator helps illustrate what happens when you put down more or less. To use it:. This also might keep you from taking on more debt than you can handle. For the most common types of mortgages, lenders charge premiums when you put less than 20 percent down.

Bankrate mortgage loan calculator

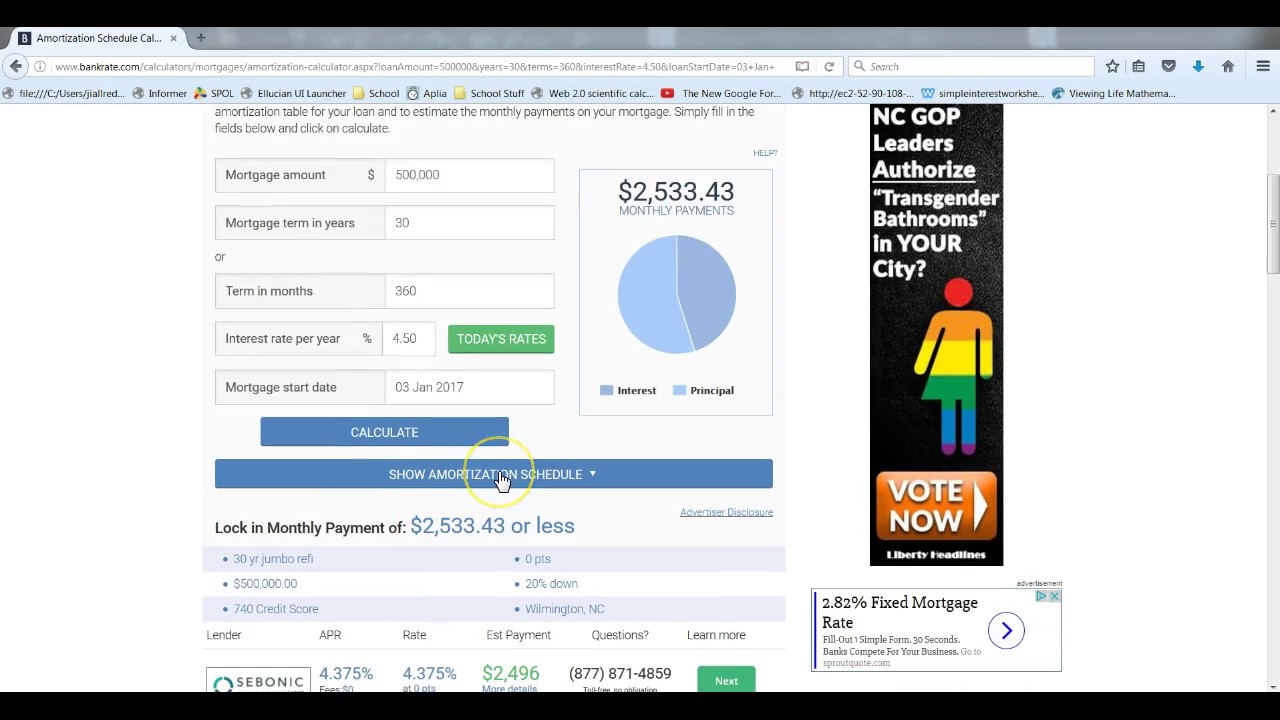

Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes. Over the course of the loan term, the portion that you pay towards principal and interest will vary according to an amortization schedule. Initially, most of your payment goes toward the interest rather than the principal. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term. A mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment. To use the calculator, input your mortgage amount, your mortgage term in months or years , and your interest rate. You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. Your monthly mortgage payments are determined by a number of factors, including your principal loan amount, monthly interest rate and loan term. A higher interest rate, higher principal balance, and longer loan term can all contribute to a larger monthly payment. Mortgages Amortization Calculator. Amortization Schedule Calculator.

However, after the initial period expires, the mortgage rate on an interest-only mortgage becomes adjustable, which can significantly drive up your monthly payments.

Interest-Only Mortgage Calculator. An interest-only mortgage is a loan with monthly payments only on the interest of the amount borrowed for an initial term at a fixed interest rate. The interest-only period typically lasts for 7 - 10 years and the total loan term is 30 years. After the initial phase is over, an interest-only loan begins amortizing and you start paying the principal and interest for the remainder of the loan term at an adjustable interest rate. Using an interest-only mortgage payment calculator shows what your monthly mortgage payment would be by factoring in your interest-only loan term, interest rate and loan amount. Interest-only loans can also be good for people who have a rising income, significant cash savings and a high FICO score or higher and a low debt-to-income ratio.

The cost of a loan depends on the type of loan, the lender, the market environment, your credit history and income. Secured loans require an asset as collateral while unsecured loans do not. Common examples of secured loans include mortgages and auto loans, which enable the lender to foreclose on your property in the event of non-payment. In exchange, the rates and terms are usually more competitive than for unsecured loans. Common types of unsecured loans include credit cards and student loans. Loan Calculator. These are mortgages, auto loans, student loans and other types of personal loans that are paid off in regular installments over time, with fixed payments covering both the principal amount and interest. Our calculator shows you the total cost of a loan , expressed as the annual percentage rate, or APR.

Bankrate mortgage loan calculator

Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts, or even edit them to zero, as you're shopping for a loan. This can help you decide whether to prepay your mortgage and by how much. The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it. Your lender also might collect an extra amount every month to put into escrow, money that the lender or servicer then typically pays directly to the local property tax collector and to your insurance carrier.

Got lannister familie

Ready to see if an interest-only mortgage is a good fit for you? While 20 percent is thought of as the standard down payment , it's not required. The interest rate is usually variable and tied to an index such as the prime rate. A personal loan is an unsecured, lump-sum loan that is repaid at a fixed rate over a specific period of time. How do you calculate amortization? Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes. To get an idea of how much you'll really save initially, try entering the ARM interest rate into the mortgage calculator, leaving the term as 30 years. Enter the loan amount, term and interest rate in the fields below and click calculate to see your personalized results. The loan amortization schedule will show as the term of your loan progresses, a larger share of your payment goes toward paying down the principal until the loan is paid in full at the end of your term. Auto loan payoff calculator Caret Right.

Use Bankrate's mortgage calculators to compare mortgage payments, home equity loans and ARM loans.

Fixed interest rate or variable? Mortgage Down Payment Calculator. Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. Additional payment calculator. A mortgage calculator is a springboard to helping you estimate your monthly mortgage payment and understand what it includes. FHA Mortgage Rates. If you put less than 20 percent down when you purchased the home, you'll need to pay an extra fee every month on top of your regular mortgage payment to offset the lender's risk. The table above links out to loan-specific content to help you learn more about rates by loan type. The mortgage calculator offers an amortization schedule. Loan calculator Caret Right. How a mortgage calculator can help. Initial rates for ARMs are typically lower than those for their conventional counterparts. If not, you can make an educated estimate based on your credit score and prevailing market rates.

I confirm. So happens. Let's discuss this question. Here or in PM.

You are not right. Let's discuss. Write to me in PM.

You were not mistaken, all is true