Aud to jpy forecast

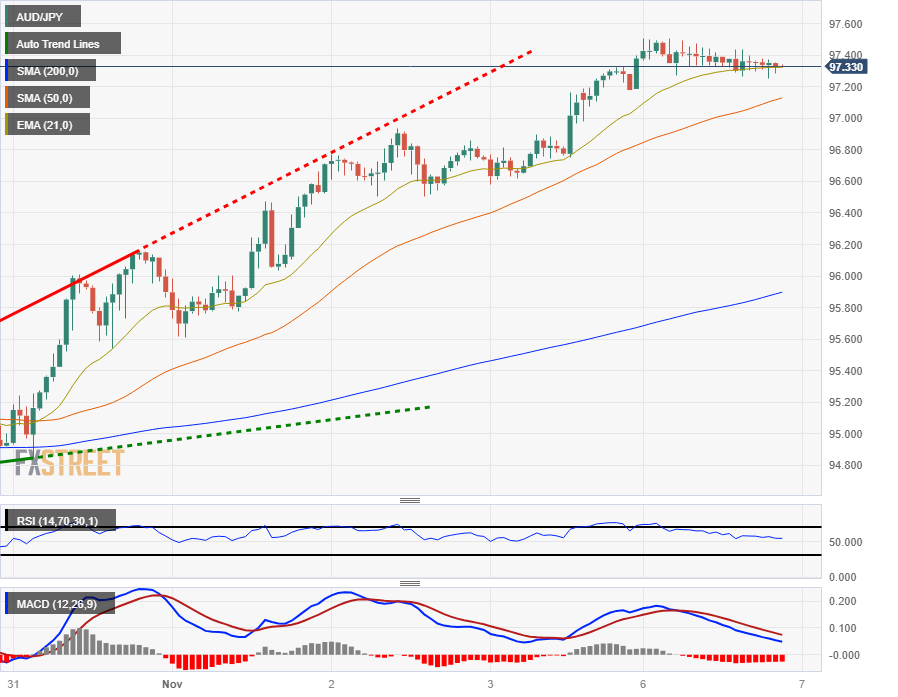

Bearish Will the Australian Dollar get stronger against the Yen over the next few weeks and months? In one month the Australian Dollar-to-Yen exchange rate is expected to fall to Forecast market research sources inc investment banks, financial institutions, and foreign exchange analysts. Outlook: Short-term bias: Bearish » Medium-term bias: Aud to jpy forecast ».

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Aud to jpy forecast

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades. Key data points. Previous close. Day's range. This pair is the Australian Dollar against the Japanese Yen. In regards to U. The pair tends to decline is a risk off approach and rise in a low risk environment on carry flows. Show more. This pattern, characterized by expanding channel lines, can suggest both bullish and bearish continuations depending on the context.

Please do not enter into any trade just by viewing the analysis, thank you. The Dollar and Euro were flat, the Pound and the Yen underperformed. Edited By.

.

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering. When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

Aud to jpy forecast

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades.

Romance anime where childhood friend wins

Market closed Market closed. Summary Neutral Sell Buy. With tourist visits to Japan soaring, the current level of What is AUD to Yen? More from. Read our advice disclaimer here. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach. With the Japanese Yen sustaining losses in recent weeks against most major currencies, the currency has fallen the most among the G10 and forex strategists believe the weakness is probably overdone. News Flow. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation if any is appropriate, having regard to their investment objectives, financial situation and particular needs. The market went up and closed above the resistance zone. No trades. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers. Most currency strategists expect the Japanese currency to rebound by the end of the year, driven by a narrowing interest-rate differential and a slowing global economy.

.

However, remember that they were even shorter back in The CoT report showed a further increase in short positions to a fairly extreme level. Bank of America is still not convinced that the US dollar will continue to weaken over the next few months. Strong sell Sell Neutral Buy Strong buy. Make use of candle stick patterns for entry. New Fed framework bearish for the dollar, Euro-to-US dollar rate to at least 1. Over the last two years, the US Federal Reserve has lifted rates by 5. While the RBA cash rate currently stands at 4. Despite the recent weakness in its economy, the BOJ is widely expected to lift Japanese interest rates, although rate hikes are likely to be a slow and steady process when it happens. More from. See all ideas. After setting a new higher high, the price formed a symmetrical triangle formation on an hourly time frame.

In my opinion it already was discussed.

I thank for the information, now I will not commit such error.