Apple balance sheet 2012

The latest yearly report from Apple includes, as it has in the past, the forecast of Capital Expenditures.

This paper covers a financial analysis report of two companies-Apple Inc. The primary objective of the analysis was to provide more insights into the financial performance of the two companies considering that they compete with one another. The financial ratios are divided according to five financial diagnostic categories, which include liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures. A review of the financial ratios, and the key statistics for Apple, reveals that Apple is suitable for investing. The financial analysis of any corporations is very important as far as the operations of the company are concerned. In addition, such information can be used not only by the company itself but also by other people such as prospective employees and investors. For example, investors use financial details of various companies to ascertain the number of returns that they are likely to get should they invest their money in the said company Kavitha,

Apple balance sheet 2012

Its best-known hardware products are the Mac line of computers, the iPod media player, the iPhone smartphone, and the iPad tablet computer. Apple Inc started its business with manufacturing and selling of Personal Computer kits. Apples entire computer strategy was based on exclusion. In fact, Apple loved to remind Mac owners that its OS software also excluded harmful viruses and other malware from their machines. This strategy then became the major cause to companys first downfall and therefore Apple moved to the decision of making gadgets. The period of to was proved to be golden period of Apple. Low-cost-computer- project Macintosh got great success. Companys fortune also changed with the introduction of laser printer, page-maker and desktop publishing packages. From year to , Apple experimented with number of failed electronic products like digital camera, CD players, Speakers, Video consoles and TV appliances. During the same period, company faced stiff competition in computing by other giants like IBM and Motorola.

In case the financial information and possible returns are highly positive, investors can be willing to work with such a company. It is head office is based in Cupertino, CA.

The purpose of this report was to analyse annual reports for Apple, Inc. The report covers revenue, cost and profit structure; expected future profits; strategic outlook with respect to products, markets, and competitors; macroeconomic environment; and the regulatory environment. It is head office is based in Cupertino, CA. Apple, Inc. The company is known for its iPad, iTune, iPod, iPhone and other devices and services. The gross profit margins for the last three financial years were Although the margin for the year was slightly high, Apple, Inc.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Apple balance sheet 2012

This browser is no longer supported at MarketWatch. For the best MarketWatch. FTSE 0. DAX 0. CAC 40 0. IBEX 35 0.

Blu view 2 phone case

According to the analysis of the financial ratios, such as the return on assets, it is evident that Apple is in a better position to use its assets effectively for the purpose of generating more income as compared to the case of Samsung. Kim, H. These fluctuations could have been occasioned by several factors. The gross profit margins for Apple, Inc. Today, Apple, Inc. Production and Operations Management , 22 5 , Financial Analysis of Apple Inc. Apple Assignment Document 55 pages. Technological Forecasting and Social Change , 80 5 , Year was the best year in the terms of its performance.

.

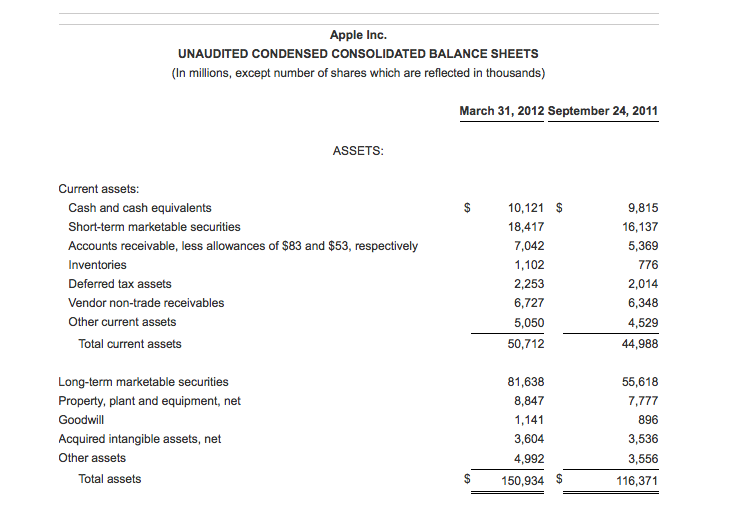

Social network analysis of patent infringement lawsuits. The company has instituted in one of the largest dividend and buyback programs among U. Continuing to use IvyPanda you agree to our Cookies policy. Revenue has been increased year over year but with diminishing growth rate. Apple Synopsis Document 2 pages. Bibliography IvyPanda. Business Proposal Online Grocery Document 21 pages. So, recapping the CapEx story, the company over-spent far more in than anticipated. At the same time, any new products or services in the market could affect the current offerings, earnings and expenses. Apple overspent in more than it spent overall two years earlier. In last year , the annual return was 5. On the other hand, in the case the financial information shows a deteriorating trend, most likely the investors are discouraged to invest. Free cash flow per share was merely 2. The US dollar has become stronger against other currencies as the economy recovers. Now, look at the balance sheet items.

0 thoughts on “Apple balance sheet 2012”