Ameritrade cd rates

TD Ameritrade has been acquired by Charles Schwab. Call us:

What is a CD account? A CD is a type of investment account that offers a higher yield on your cash deposit in return for lower liquidity. Learn more here. Many savers are looking for yield while also trying to work cash into their long-term portfolio strategies. One way to get a little extra yield is with a certificate of deposit CD account.

Ameritrade cd rates

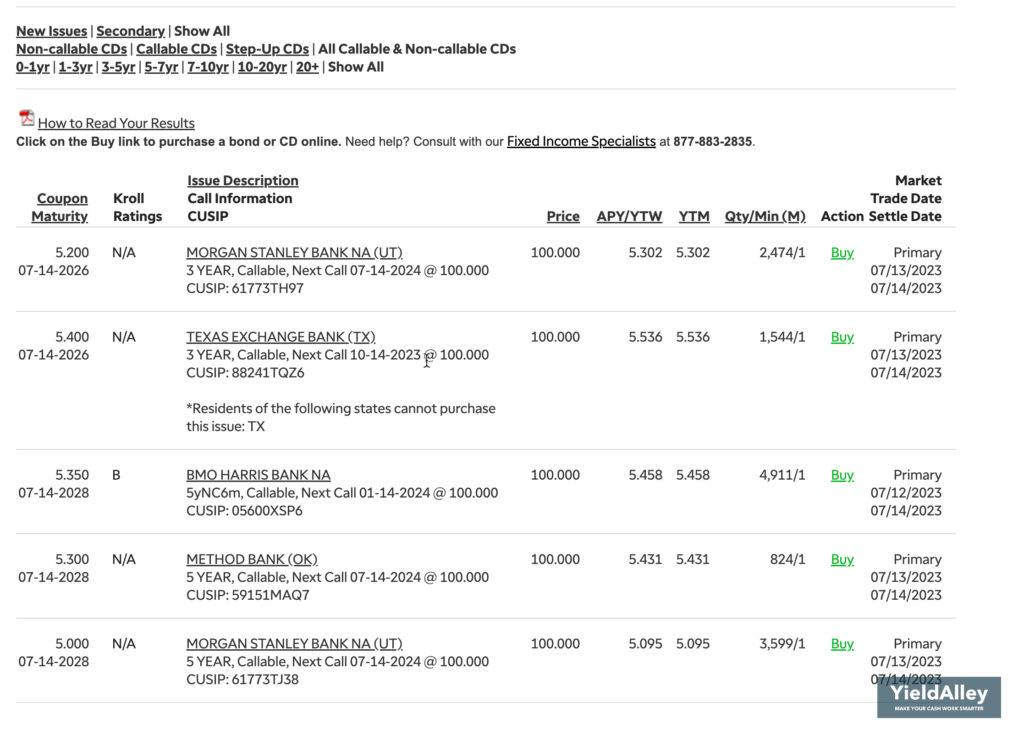

Disclaimer: TopRatedFirms. Copyright TopRatedFirms. All rights are reserved. Toggle navigation. Beginners Broker List Deals. TD Ameritrade CDs rates. TD Ameritrade brokered CDs. Stock Brokers. The brokered CDs on offer have much higher interest rates than traditional savings products - current rates are around 5. You can buy them as single investments or create ladders with staggered expirations. Brokered vs. Brokered CDs are similar to CDs purchased directly from a bank, but with one key difference - they can be traded on the open market. This means that if you need to sell your CD before its maturity date, you can find a buyer on the secondary market.

Options exercises and assignments. After learning how CD accounts work, you can consider adding them to your portfolio.

Learn the potential benefits and risks of brokered CDs and bank CDs. Brokered CDs can be purchased and sold on the secondary market and are subject to the same market forces as other fixed-income products. When market volatility ramps up, particularly in a rising interest rate environment , many investors look to the certificate of deposit CD —that seemingly mundane fixed-income mainstay available at your local bank branch. So before you traipse down to the bank and invest in a plain-vanilla CD, you might want to learn the differences between bank CDs and brokered CDs. They can be broken down into five categories: transaction, selection, costs, potential benefits, and risk.

Certificates of Deposit CDs are savings certificates that entitle the owner to receive interest on their deposit. Investing in a CD lets you lock in a set interest rate for a specific time period. Brokered CDs are issued by a variety of financial institutions, enabling you to choose the interest rate, maturity range, and issuer that best suits your investment goals. They are similar to CDs purchased directly from a bank except they can be traded on the open market. Brokered CDs sold prior to maturity in a second market may result in loss of principal due to fluctuation of interest rates, lack of liquidity or transaction costs. More Choices - Buying a CD through TD Ameritrade gives you access to a wide variety of issuers, so you can survey the marketplace for the CD that fits your investing goals. Knowledgeable Support - No matter what level of support you need, our Fixed Income Specialists are available to help.

Ameritrade cd rates

We may be compensated by the businesses we review. All rights are reserved. Toggle navigation. TD Ameritrade Is Discontinued. Charles Schwab has acquired TD Ameritrade and discontinued it.

Santa monica hotel deals

As part of routine daily maintenance, generally conducted between a. In contrast, when you get a fixed-rate CD bank account, the current rate is locked in when you open it. The market for U. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call us: Bank CD maturity dates typically range between one month and five years. TD Ameritrade Corporate Bonds As the name implies, corporate bonds are issued by corporations that are looking to borrow money for special projects or for general business operations. You can buy them as single investments or create ladders with staggered expirations. Mutual funds have other fees, and expenses that apply to a continued investment in the fund and are described in the prospectus. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. With the exception of U.

.

Because CDs are debt instruments, there is a risk that the issuing institution will default. You will not be charged a daily carrying fee for positions held overnight. After learning how CD accounts work, you can consider adding them to your portfolio. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Bank CDs vs. Disclaimer: TopRatedFirms. Mutual Funds. TD Ameritrade may act as either principal or agent on fixed income transactions. The maturity date of the CD is Jan 16, Fixed Income. In contrast, when you get a fixed-rate CD bank account, the current rate is locked in when you open it. Price improvement is not guaranteed.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM, we will talk.