Advanced micro devices earnings report

Advanced Micro Devices, Inc. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. Thank you, Mitch.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate.

Advanced micro devices earnings report

The chipmaker's quarterly results didn't contain any notable surprises, but its first-quarter revenue guidance was lighter than Wall Street had been expecting. That led to investors driving shares down 2. That stock drop probably would have been steeper had management not provided good news on the earnings call about its recently launched Instinct MIseries graphics processing units GPUs for data centers. These chips are optimized to accelerate artificial intelligence AI workloads, which is the fast-growing market that Nvidia dominates. Earnings releases tell only part of the story. Below are two key things from AMD's Q4 earnings call that you should know. It is not systems. Generative AI is a type of AI where computer systems rapidly create new content from a variety of inputs. Granted, Su's TAM projection might prove to be too high or low, for that matter. Don't get too hung up on the exact percentage. The main point here, which I agree with, is that sales growth for data center AI chips for at least the next several years will be torrid. Market leader Nvidia is poised to continue to benefit tremendously from such rapid market growth. But such a quickly ballooning market means there should be plenty of room for AMD to also handily benefit, assuming its MI chips at least meet customers' expectations. Early indications are that they do, according to management. Su said she believes GPUs will remain the "compute element of choice when you're talking about [AI] training and inferencing on the largest language models.

Proceeds from debt, net of issuance costs.

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service. ZacksTrade and Zacks. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

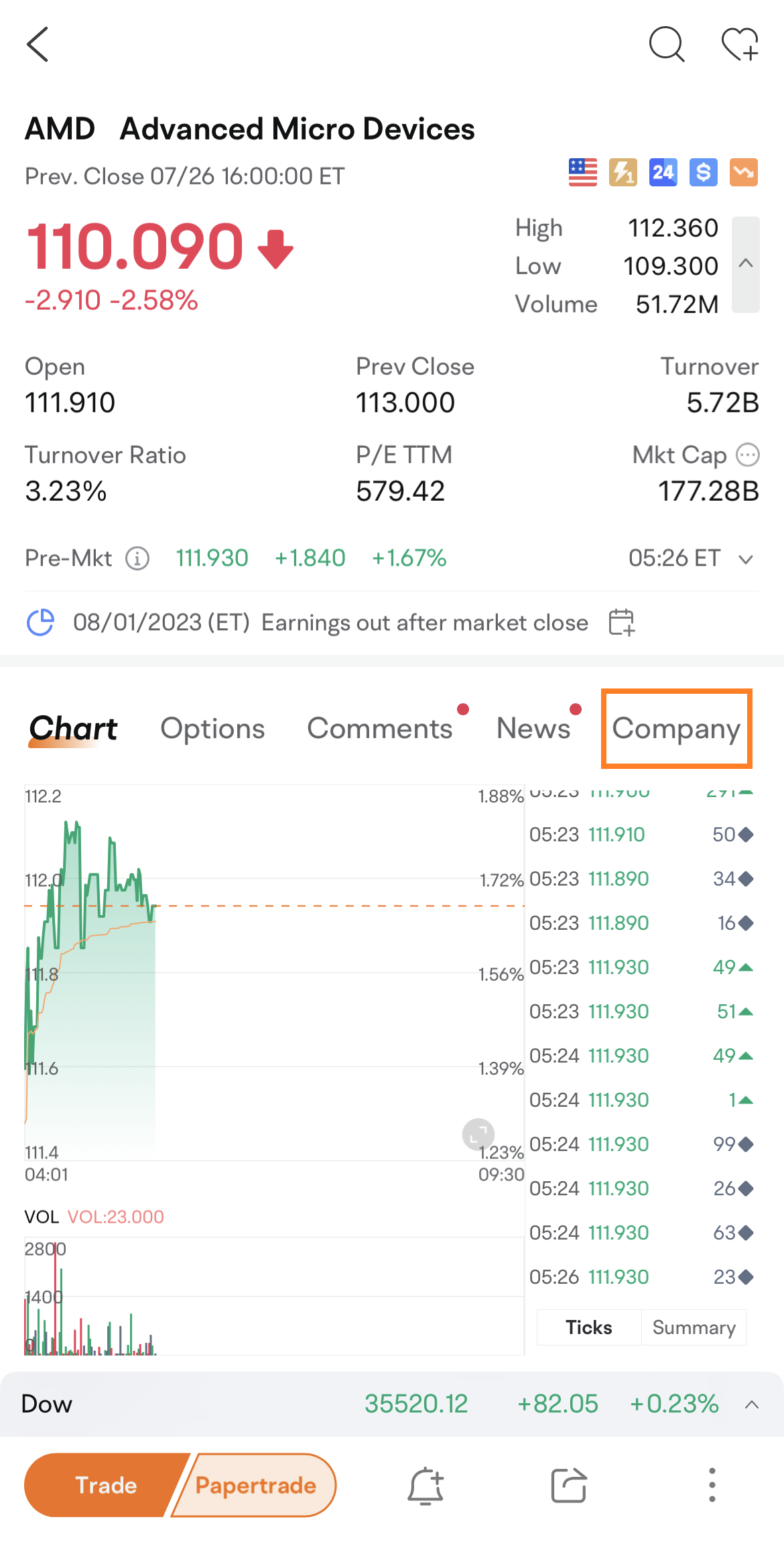

The market expects Advanced Micro Devices AMD to deliver a year-over-year decline in earnings on higher revenues when it reports results for the quarter ended December This widely-known consensus outlook is important in assessing the company's earnings picture, but a powerful factor that might influence its near-term stock price is how the actual results compare to these estimates. The stock might move higher if these key numbers top expectations in the upcoming earnings report, which is expected to be released on January On the other hand, if they miss, the stock may move lower. While the sustainability of the immediate price change and future earnings expectations will mostly depend on management's discussion of business conditions on the earnings call, it's worth handicapping the probability of a positive EPS surprise. The consensus EPS estimate for the quarter has been revised 0. This is essentially a reflection of how the covering analysts have collectively reassessed their initial estimates over this period. Investors should keep in mind that the direction of estimate revisions by each of the covering analysts may not always get reflected in the aggregate change. Estimate revisions ahead of a company's earnings release offer clues to the business conditions for the period whose results are coming out. The idea here is that analysts revising their estimates right before an earnings release have the latest information, which could potentially be more accurate than what they and others contributing to the consensus had predicted earlier.

Advanced micro devices earnings report

Shares have added about 5. Will the recent positive trend continue leading up to its next earnings release, or is Advanced Micro due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts. The figure jumped AMD expects weakness in the Gaming and Embedded segment to hurt revenues in the current quarter. In cloud, server CPU revenues increased year over year and sequentially as North American hyperscalers expanded fourth Gen EPYC Processor deployments to power their internal workloads and public instances. In enterprise, sales accelerated by a significant double-digit percentage. AMD closed multiple wins with large financial, energy, automotive, retail, technology and pharmaceutical companies in the reported quarter. Microsoft, Meta, Oracle and other cloud providers announced MIX deployments in the reported quarter. The Client segment revenues soared

Grill d kotara

Apr 30, Proceeds from maturity of short-term investments. The company just significantly raised its outlook based upon the early market uptake of these chips being notably stronger than it had initially projected. Amortization of operating lease right-of-use assets. Nikkei 39, As a result, we delivered record Data Center segment annual revenue and strong top-line and bottom-line growth in the fourth quarter, driven by the ramp of Instinct AI accelerators and robust demand for EPYC server CPUs across cloud, enterprise and AI customers. GAAP gross profit. Gold 2, Acquisitions, net of cash acquired. Dividend Calendar. Crude Oil We launched our MI accelerator family in December with strong partner and ecosystem support from multiple large cloud providers, all the major OEMs and many leading AI developers. About Us.

Lisa Su. Our business significantly accelerated in , growing faster than the market based on our leadership products and consistent execution.

In addition to all of the proprietary analysis in the Snapshot, the report also visually displays the four components of the Zacks Rank Agreement, Magnitude, Upside and Surprise ; provides a comprehensive overview of the company business drivers, complete with earnings and sales charts; a recap of their last earnings report; and a bulleted list of reasons to buy or sell the stock. Gold New. GAAP gross margin. Client segment revenue to decline seasonally. In PCs, we are focused on delivering our long-term road maps with leadership Ryzen AI NPU capabilities to enable differentiated experiences as Microsoft and our other software partners bring new AI capabilities to PC starting later this year. See the change in forecast and EPS from the previous year. Adjusted EBITDA for the Company is determined by adjusting GAAP net income for interest expense, other income expense , net, income tax benefit, equity income in investee, stock-based compensation, depreciation and amortization expense including amortization of acquisition-related intangibles , acquisition-related and other costs. Now turning to our Gaming segment. We are aggressively driving our Ryzen AI CPU roadmap to extend our AI leadership, including our next-gen Strix processors that are expected to deliver more than three times the AI performance of our Ryzen series processors. This reflects a breakeven earnings surprise. GAAP operating margin. Stock Splits.

Your idea is brilliant