Actuary salary

The average actuary gross salary in Madrid, actuary salary, Spain is In addition, they earn an average bonus of 3. Salary estimates based on salary survey data collected directly from employers and anonymous actuary salary in Madrid, Spain. An entry level actuary years of experience earns an average salary of

Do you know what your employees really want for the holidays? Whether you are hiring a single employee , or an entire department of. The labor market is a strange place right now. A shift towards. Handling involuntary termination is a likely occurrence for human resources managers and.

Actuary salary

An actuarial career is a very desirable one and there are many reasons for this. Job security, the ability to work anywhere in the world and the ability to make a real impact on a business, to name but a few. Another reasons an actuarial career is so desirable is the financial reward that comes with it. Wherever you go in the world, you will find that actuaries are rewarded highly for their efforts. In this article, we look at whether actuaries are paid as well as everyone thinks, why they are paid well and more reasons you should consider becoming an actuary. The long answer is that the starting salary for trainee actuaries is higher than the UK average salary and this increases as you become qualified and work your way up the career ladder. In some instances, you could be looking at earning six figures. Your actual starting salary, should you secure a place on an actuarial graduate scheme, depends on a number of factors including your employer and your location. As you work your way up the actuarial career ladder and into more senior roles, your salary will increase quite substantially. While being an actuary can see you earn a lot of money, it does come at a price.

What your skills are worth in the job market is constantly changing.

You'll use your knowledge of business and economics, together with your understanding of probability theory, statistics and investment theory, to provide strategic, commercial and financial advice. Using financial and statistical theories, you'll assess the likelihood of a particular event occurring and its possible financial costs. You should expect to work overtime, but not necessarily at the weekends or in shifts. In traditional areas of employment, long hours are less likely for more junior staff, e. Flexible and part-time work, as well as career breaks, can be negotiated - but this is usually dependent on the employer and your individual circumstances. Although this area of work is open to all graduates with strong numerical skills, the following degree subjects may increase your chances:. Graduates must have a minimum of grade B in A-level mathematics and a grade C in another A-level subject.

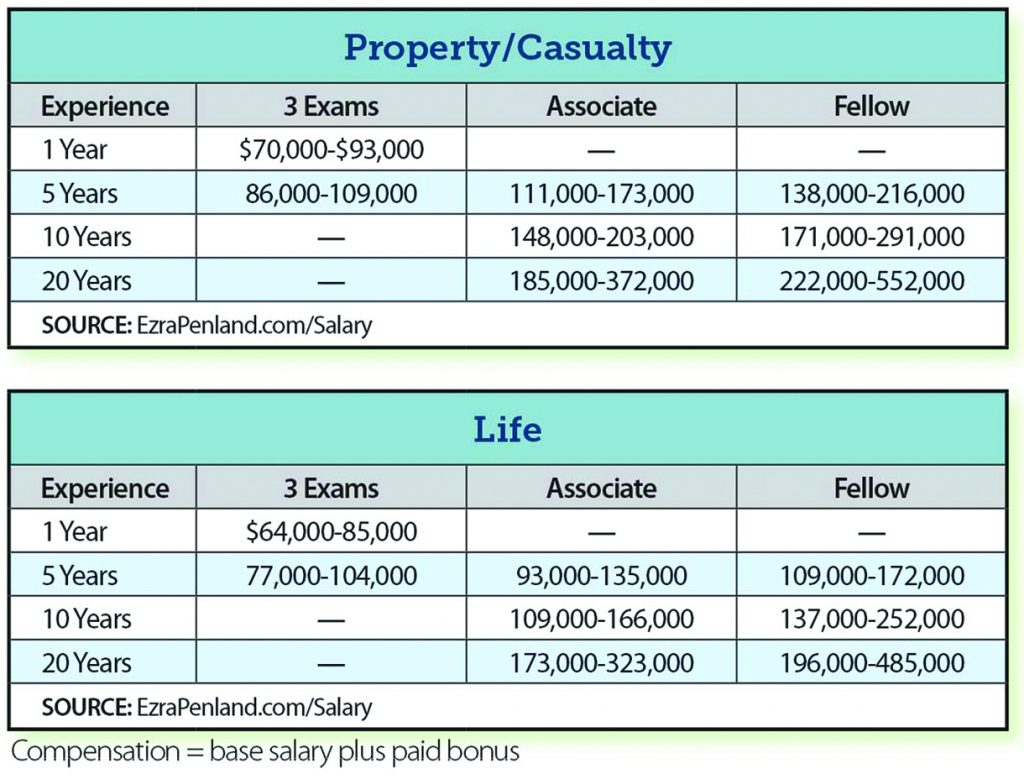

Updated September 28, Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. Are you ready to discover your college program? Actuaries use mathematical analysis to help businesses manage financial risk and make sound business decisions. Actuary salary varies by location, industry, and experience. Keep reading to learn more about the average actuary salary, along with earning potential and job prospects in the field.

Actuary salary

Salary ranges can vary widely depending on the actual Actuary position you are looking for. With more online, real-time compensation data than any other website, Salary. View the Cost of Living in Major Cities. An actuary uses math, statistics, computer modeling, and analysis to evaluate risk. They look at various events that could occur either to a person or to business and develop scenarios to minimize risk and cost. Many actuaries are employed in the insurance industry and may specialize in an area like health insurance, life insurance, or property insurance. Conducts analysis, pricing and risk assessment to estimate financial outcomes. Applies knowledge of mathematics, probability, statistics, principles of finance and business to calculations in life, health, social, and casualty insurance, annuities, and pensions. Develops probability tables regarding fire, natural disasters, death, unemployment, etc. View job details.

Memphis current time

It is also possible to pursue particular areas of interest such as genetics, energy supply or climate change. Employers typically look for a or above, ideally in a numerate subject such as mathematics, statistics or economics. Mean Median. Do not fill this in. In this article, we look at whether actuaries are paid as well as everyone thinks, why they are paid well and more reasons you should consider becoming an actuary. An actuarial career offers a great deal of flexibility, and although an actuary may choose a particular area of specialisation such as consultancy, investments, life assurance, general insurance, pensions or reinsurance, it's still possible to change areas later in your career. Job Description. Pay increases are a top concern for to attract and retain talent Do you know what your employees really want for the holidays? Most Popular Skills for Actuary. Jobs and work experience Search graduate jobs Job profiles Work experience and internships Employer profiles What job would suit me? Get My Personal Pay Report. With a PhD-level research team in house, SalaryExpert, provides up-to-date salary and compensation data. Specialist recruitment agencies such as Oliver James , Emerald Group and Star Actuarial Futures handle vacancies and often advertise in the financial vacancy sections of the press or in professional journals. Subscribe to our newsletter. Qualifications Although this area of work is open to all graduates with strong numerical skills, the following degree subjects may increase your chances: actuarial science or actuarial mathematics business or finance economics engineering mathematics or statistics risk management science, e.

The two interactive charts on this page will allow you to query the data collected from our Salary Survey Questionnaire.

What your skills are worth in the job market is constantly changing. Is Average Actuary Salary in Spain your job title? Salary Research Uncover detailed salary data for specific jobs, employers, schools, and more. Explore Our Salary Database. An actuarial career offers a great deal of flexibility, and although an actuary may choose a particular area of specialisation such as consultancy, investments, life assurance, general insurance, pensions or reinsurance, it's still possible to change areas later in your career. Retail and Customer Service. Flexible and part-time work, as well as career breaks, can be negotiated - but this is usually dependent on the employer and your individual circumstances. Quickly search for salaries in other careers and locations in our salary database. Career Advice. University life Changing or leaving your course Alternatives to university. Student actuaries take exams at their own pace through self-study, as well as a mixture of distance learning courses and tutorials supplied by specialist providers such as the Actuarial Education Company ActEd. For instance, some actuaries move from pension firms to work in investment banks or asset management firms, or into large corporations. Jobs are widely available in most large towns and cities in the UK, although London has the largest proportion of jobs. They use a great deal of statistical analysis in their work, as they examine huge amounts of data related to costing and trends. What's this?

True phrase