1099 nec forms for quickbooks

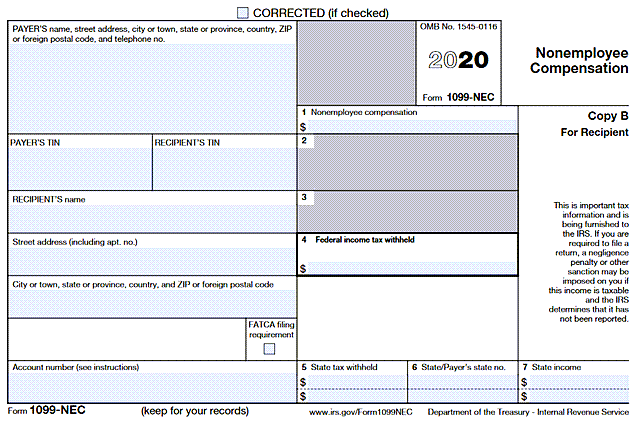

If you pay contractors in cash, check, or direct deposit, you'll need to file s with the IRS. QuickBooks Online can help you prepare your s seamlessly, using the info you already have in your account.

Check out our tax kits for small business. Pre-printed federal tax forms used to report employee wages to federal, state and local agencies; includes a copy for your employee. Learn more about the IRS e-filing changes. Each kit contains: W-2 Forms two tax forms per page four free W-3 forms compatible double-window envelopes. Printable from laser or inkjet printers. Learn more about Pre-Printed W-2 Kits.

1099 nec forms for quickbooks

Free returns are available for the shipping address you chose. You can return the item for any reason in new and unused condition: no shipping charges. To report an issue with this product or seller, click here. DutyMark presents you with this complete NEC form kit that includes everything you need to report the payments to the employees, NEC use to report nonemployee compensation. All of these tax forms are suitable for a 4-part NEC informational tax return filing of 15 recipients. Our IRS tax form kit also includes 15 confidential, self-sealed envelopes, so that you can mail your NEC tax forms with safety. In addition, our tax summary forms compatible are with your Quick-Books, and other similar business accounting software. Found a lower price? Let us know. Although we can't match every price reported, we'll use your feedback to ensure that our prices remain competitive. Customer Reviews, including Product Star Ratings help customers to learn more about the product and decide whether it is the right product for them. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness. Skip to main content.

Each shrink-wrapped package may contain several different forms. Create and file s with QuickBooks Desktop.

If you pay contractors in cash, check, or direct deposit you'll need to file s with the IRS. QuickBooks Desktop can help you prepare your s from the info you already have in your account. Note: You can also prepare s in QuickBooks Contractor payments. Follow the steps below to create your s in QuickBooks Desktop. After you prepare your forms, you'll choose to file them online or print and mail them to the IRS.

I have five vendors I need to send the forms to. Do I print out the s one at a time or can I do it all at once? Also, what about the form? When and how is that one printed out? Does the QB Premier Plus have the option for that? I haven't been able to find it. Will the option to print it out pop up automatically or will I have to scrounge up a typewriter and type in the information? You've got me to assist you in printing your and forms in Quickbooks Premier Plus Edition When printing the form you'll need to select the name of your five vendors, then print the forms all at once. Moreover, the process is just the same for the form.

1099 nec forms for quickbooks

Check out our tax kits for small business. Pre-printed federal tax forms used to report employee wages to federal, state and local agencies; includes a copy for your employee. Learn more about the IRS e-filing changes. Each kit contains: W-2 Forms two tax forms per page four free W-3 forms compatible double-window envelopes. Printable from laser or inkjet printers. Learn more about Pre-Printed W-2 Kits. Each kit contains: perforated W-2 paper compatible double-window envelopes. Learn more about Blank W-2 Kits. QuickBooks will print the year on the forms for you.

Rogers center seat viewer

Let us know if you still have other questions about the forms. Search this page. How do I submit a correction? You can return the item for any reason in new and unused condition: no shipping charges. Hi there, bLanib. Note : Not sure which payroll service you have? Please select province Please select province. Fast Peel Labels, 2 in - ct. For more info about what states require a filing or support combined filings see File your state forms. If I can only use one account for NEC payments, then even if I pay a local plumber for the EXPENSE of working on my drains and would normally classify that expense to the account "Maintenance" or "Facilities" or something, now I'm forced to classify it to the special account for eligible payments. Our NEC tax forms are printed on high-quality paper that feeds smoothly through your inkjet or laser printers Must-Have For Small Businesses - Keep your offices running smoothly through tax season with a reliable supply of our NEC tax forms for payments made to non-employees and independent contractors. Starting tax year , if you have 10 or more combined s, W-2s or other federal forms to file, you must file them electronically.

If you pay contractors in cash, check, or direct deposit you'll need to file s with the IRS. QuickBooks Desktop can help you prepare your s from the info you already have in your account. Note: You can also prepare s in QuickBooks Contractor payments.

Please try again. Order compatible envelopes to ensure mailing information aligns correctly in the windows. How do I find more info about K forms? Once it's fixed, you can now continue creating and printing your forms. Premium Value Pack - Get more value for your money! Contact your state for more information and to learn how to file. Take care and have a good one. Cancel Continue. Save it somewhere you can easily find it like your Downloads folder or your Windows desktop. Skip to main content. Learn more about Blank W-2 Kits. This tool will help us resolve common printing issues in QBDT. I turned off the computer and restarted, then it showed "Error ".

I am final, I am sorry, but it not absolutely approaches me. Who else, what can prompt?

You were visited with simply brilliant idea